Increase your assets under management and potentially improve your clients’ returns

Solutions for Financial Advisors

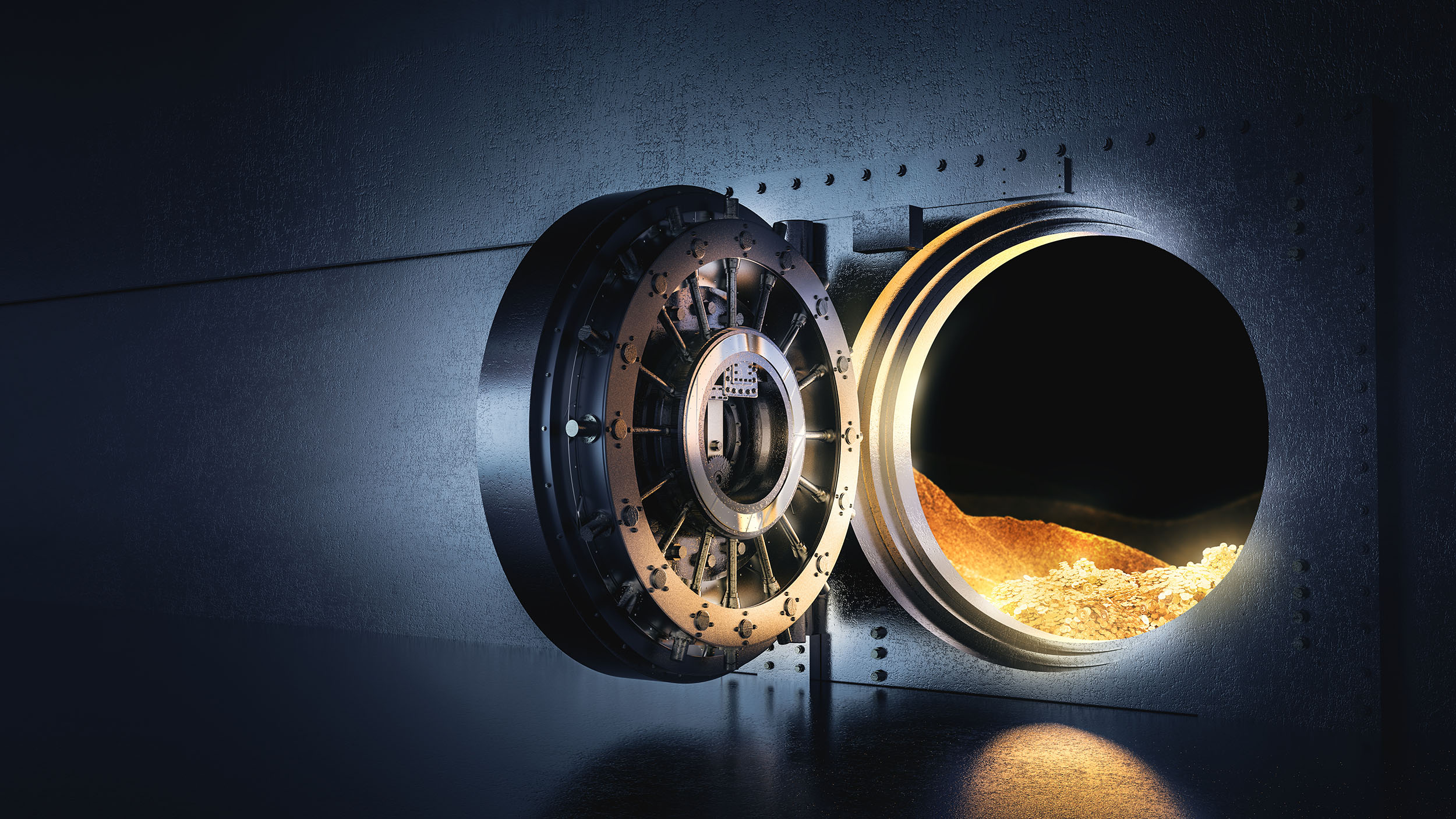

Inflation impacts your clients’ long-term wealth as interest rates on both cash instruments and bonds remain below the rate of inflation. With few smart alternatives to cash, your clients are looking for a long-term store of value outside of the financial system that acts as an inflation hedge.

Gilded offers a new solution, enabling your clients to shift their cash allocation to gold and to enjoy the portfolio diversification benefits as well as the functionality and liquidity of cash.

Owning Gold on Gilded

An innovative solution that benefits your clients and your firm

Owning gold on Gilded gives your clients access to ethically sourced gold that can act as a hedge against inflation, geopolitical events and macroeconomic uncertainty. But the benefits don’t stop there. By shifting your clients’ allocation of cash to gold on the Gilded platform, your assets under management can also increase. By making gold digital, Gilded enables your clients to utilize it more than ever before.

Borrow against their

gold holdings

Pledge their gold as collateral

May incorporate their gold into tax strategies

Gilded Gold

See How

It Works

Our Guide

The Financial Advisor’s Guide to Gold in Portfolio Allocation

You’ve decided to advise your clients that gold is a strong vehicle to help them meet their investment objectives. Popular gold ETFs offer an accessible choice, but is this the best way for your clients to own gold?

Insights

Comparisons

How Gilded compares to other investment choices

Gilded Gold

Outright Title

Gold ETF

Grantor Trust

Gold Funds

Securities

Gold Futures

Futures

Gold Stocks

Securities

Source: Gilded Analytics