Physical Gold vs. Gold ETFs

Physical Gold vs. Gold ETFs

Gold ETFs are securities and do not give you direct ownership of gold. At Gilded, the gold is your title, your property, and never part of the financial system, but has all the functionality of cash.

When it comes to investing in physical gold, you know exactly what you are buying and you get what you pay for. Gilded provides direct ownership, with the ability to take delivery and all the functionality to be able to borrow against your gold, earn a return on your gold, pledge your gold, or just safely hold your gold in a fully insured, and independently audited Brink’s vault.

While Gold ETFs have risen in popularity among investors due to their perceived convenience, the Gilded platform offers similar convenience and everything an ETF can do with more functionality.

Investment Strategies

Resilience and Flexibility With the Gilded Platform

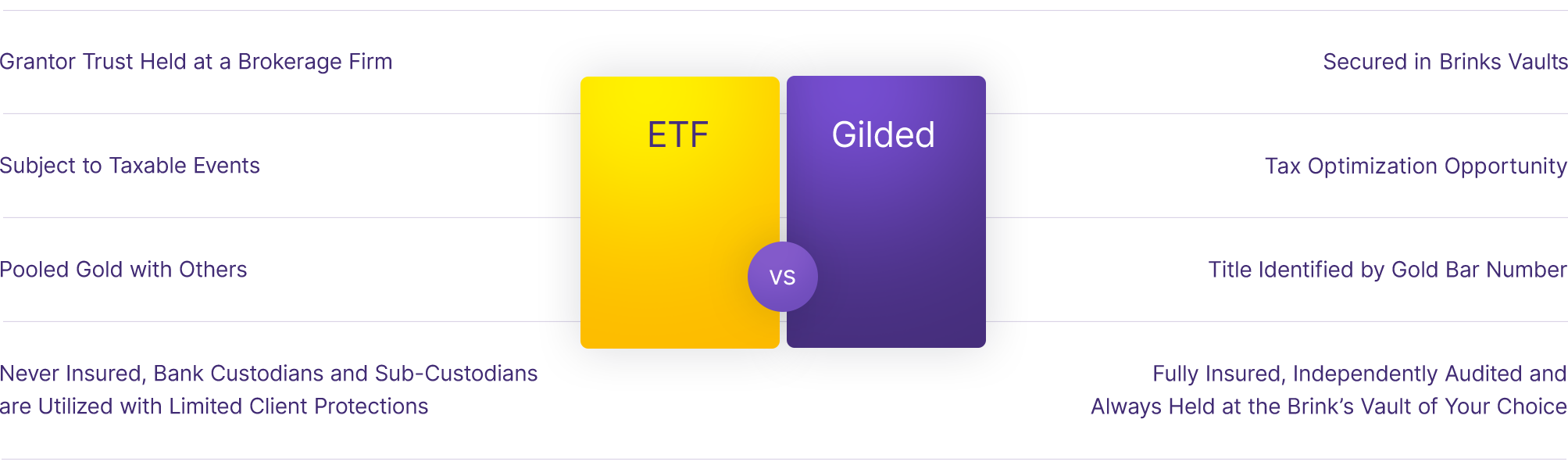

Unlike ETFs, investing in gold on the Gilded platform gives you fully allocated physical gold that is bankruptcy remote and held outside the banking system in insured vaults. With Gilded, delivery can always be arranged and fees are structured so that your gold holdings are not reduced over time due to fees. Here are some of the problems an ETF may encounter, and the solutions you’ll find when taking the long view with Gilded gold.

Comparisons

Gilded Gold is Superior to Paper Gold

Gilded Gold

Outright Title

Gold ETF

Grantor Trust

Gold Funds

Securities

Gold Futures

Futures

Gold Stocks

Securities

Source: Gilded Analytics

Our Guide

The Financial Advisor’s Guide to Gold in Portfolio Allocation

You’ve decided to advise your clients that gold is a strong vehicle to help them meet their investment objectives. Popular gold ETFs offer an accessible choice, but is this the best way for your clients to own gold?

Additional Resources

Security, Safety, Direct Ownership: Move Beyond An ETF To Functional Gold.

Start investing with Gilded now.