Research & Blogs

Gold: Looking Back at 2022 and Ahead to 2023

“January looks forward to the new year and back to the old year. He sees past and future.” – M.L. Stedman1

The first month of the calendar year takes its name from, Janus(Ianvs), the Roman god of beginnings, endings, gateways, and transitions. Often depicted with two heads, one looking back and one ahead, Janus stands at the inflection of old and new. With 2022 behind us and 2023 already afoot, we at Gilded would like to share some reflections on the past year along with our best wishes for 2023.

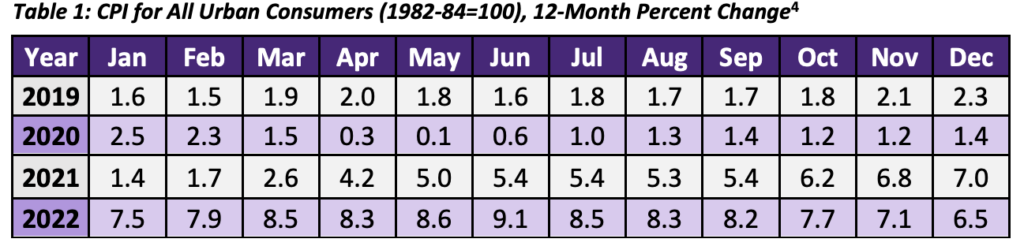

Gold has long served as a strategic asset that complements most portfolios and 2022 proved no exception. Looking back at 2022 reminds us that market prognostication is a risky business and as such, tactical asset allocation continues to elude all but the best hedge fund investors. Along these lines, predicting inflation proved problematic, even for the experts. Showcasing this dynamic in stark relief, Federal Reserve Chairman Powell introduced the word transitory to describe price pressures following the pandemic. But, far from fleeting, the unexpectedly high levels of inflation which began in March 2021 have persisted to this day.

On November 30, 2021, after nine months of inflation levels not seen since 1982,

Chairman Powell decided to drop the word, offering that, “transitory is no longer the most accurate term for describing the nature of the current high inflation rate.” For the most educated, experienced, and informed policymakers to misjudge this trend so dramatically highlights just how inexact a science economics can be. Of course, this unpredictable nature applies as much when it comes to asset class and single security returns. Any such prognostications should be met with skepticism as witnessed by the rosy equity market predictions made in late 2021 by Goldman Sachs, J.P. Morgan and others for 2022

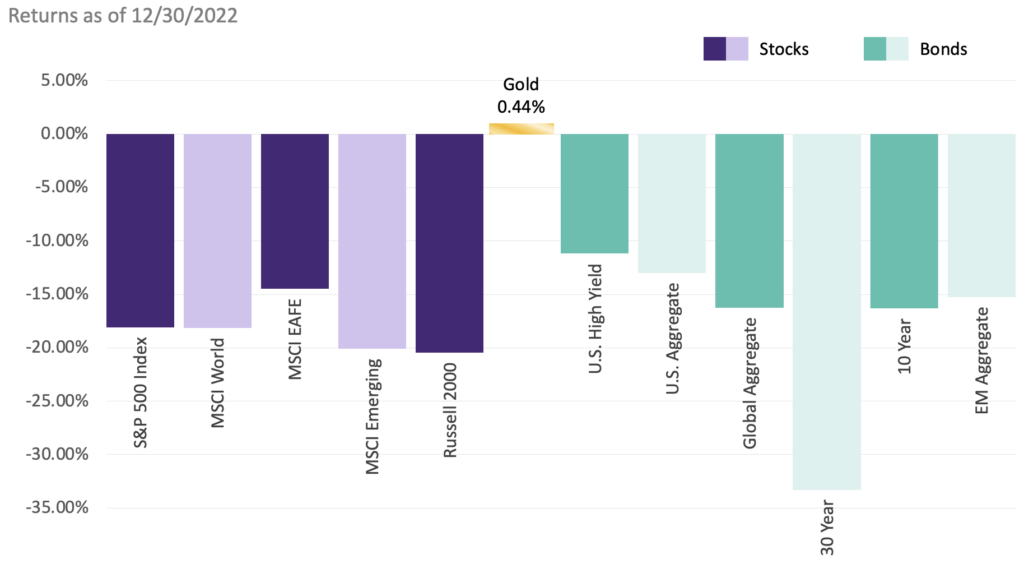

Table 2: Returns of different asset classes in 2022

Source: Gilded Analytics

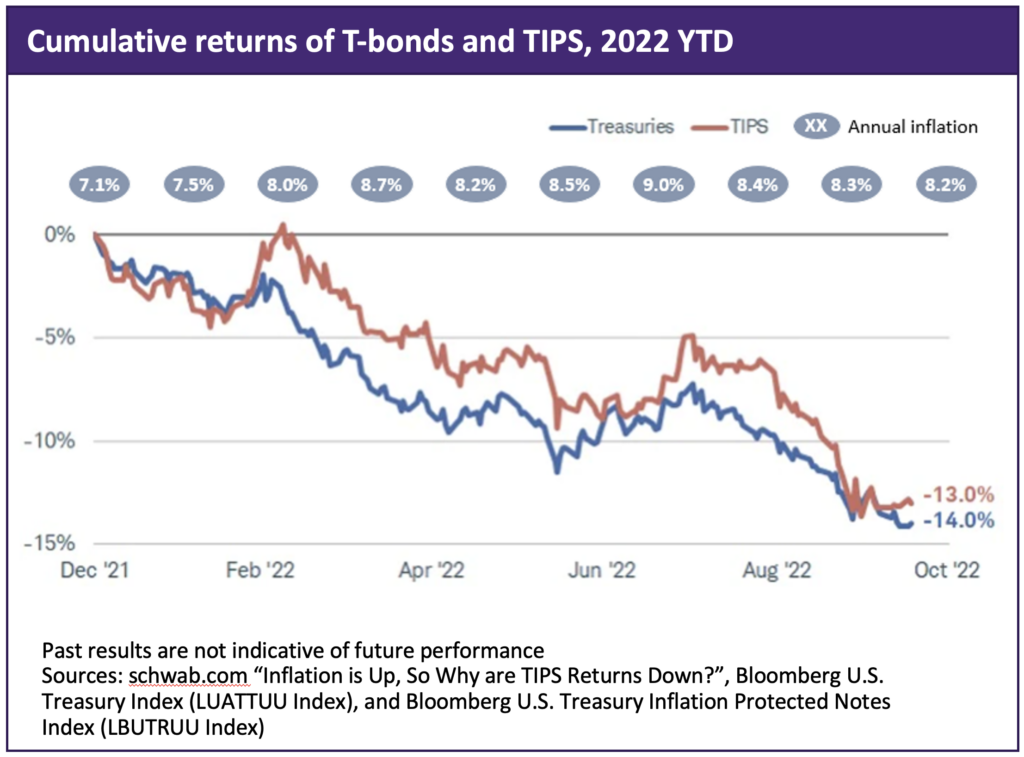

Indeed, 2022 saw the markets struggle to adapt to the persistence of inflation and to the tardy but measurable central bank responses to this shift higher in the general level of prices. Down across the board in 2022, the main gauges of equity markets fell significantly, and bonds fared little better (in the case of the benchmark U.S. 30-year bond, even worse). It is worth pointing out that even inflation protected securities, TIPS, failed to protect against the very element they are designed to guard against. Even though CPI was up 8.2% in Jan-Oct 2022, the Bloomberg U.S. TIPS Index was down 13%.

This correlation of risky assets, both stocks and bonds, begged scrutiny of the traditional 60/40 approach to portfolio construction. With losses over 24%, a portfolio comprised exclusively of equity and fixed income securities was left sorely wanting diversification. Finding uncorrelated assets with positive expected returns proved imperative in 2022. Gold historically has offered these benefits, and 2022 held true to form. Gold was a bright spot with positive, albeit modest, +0.44% returns for the year.

Despite relative outperformance of over 20% compared to equities, skeptics will question why gold failed to perform even better in the face of inflation. The answer might be that IT DID! Through the lens of most currencies that are not the United States Dollar, 2022 highlighted gold as a haven in the face of unexpected inflation with significantly positive returns as shown in the table below.

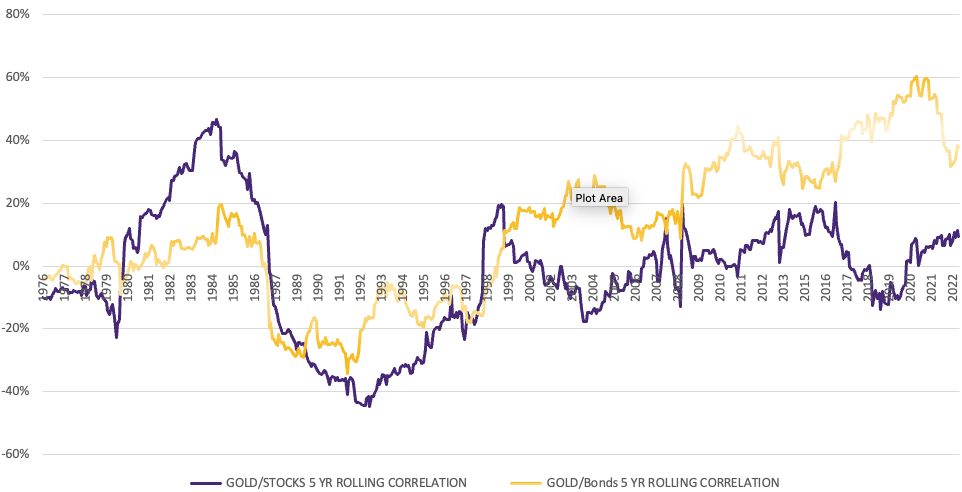

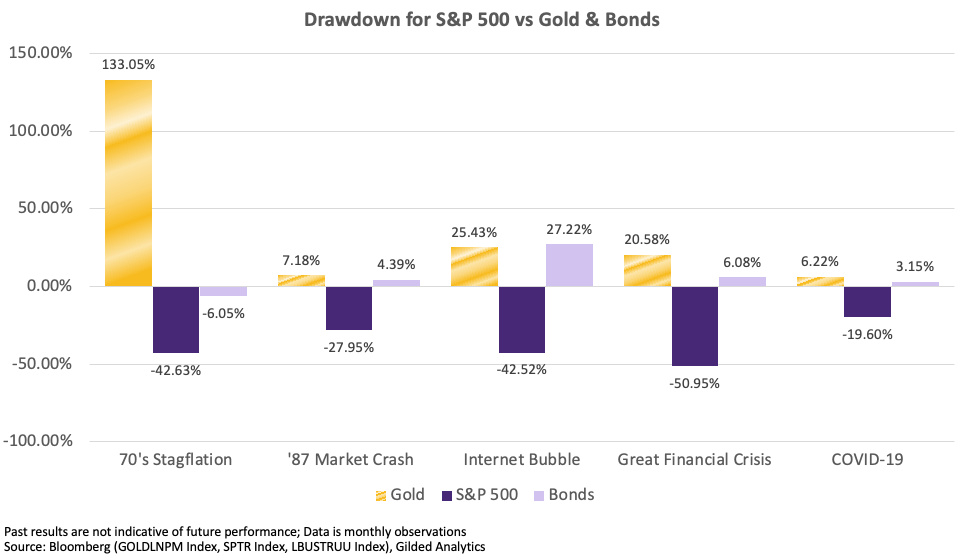

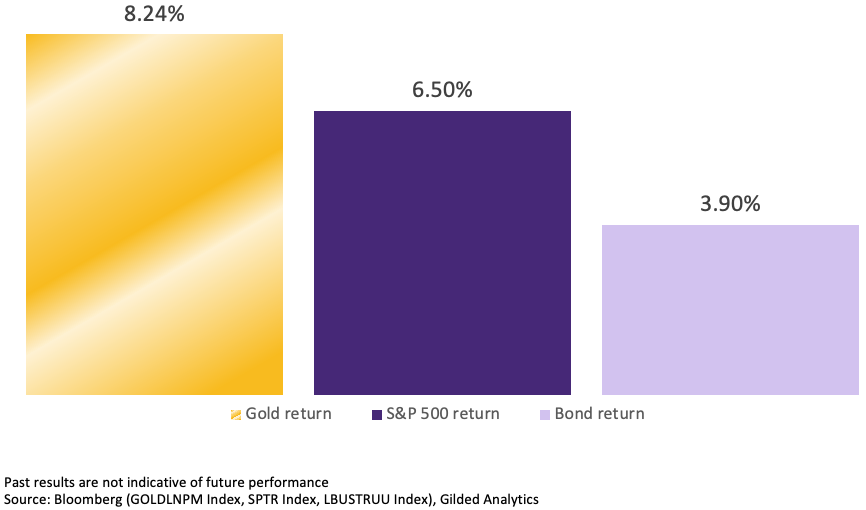

Without question this has been a difficult time for most asset classes, yet periods of stress and uncertainty like those witnessed in 2022 are to be expected. In the face of this reality, the prudent investor tries to rely on diversification to mitigate the damage a period like this can inflict on a portfolio. Gold is again proving to be the type of uncorrelated asset that can provide ballast while other asset class prices are falling. This is not a new development. Gold has consistently demonstrated compelling performance relative to equities and bonds as can be seen from data going back to 1971.

Moreover, during periods of significant market stress, gold has proven a valuable hedge. In 1987, when stocks crashed, gold outperformed by over 35%. Following the Internet bubble at the turn of the millennium, gold outperformed stocks by more than 65%. During the Great Financial Crisis of 2007-2009, gold outperformed stocks by over 70%. And at the onset of the COVID pandemic, from December 2019 to March 2020, gold outperformed stocks by over 25%.

As 2023 begins, we again find ourselves in an uncertain period where even market professionals and policy makers are struggling to figure out the extent, duration, and potential consequences of higher-than-expected inflation. Diversification serves as prudent protection for a portfolio in times like this, diversification that gold has offered in the past and did again in 2022.

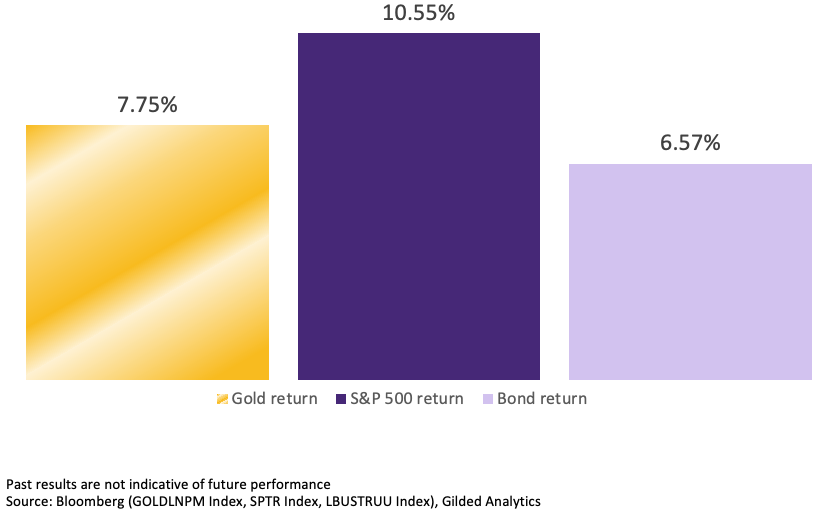

Gilded clients need no reminder of this diversification benefit and the fact that gold has served as a stable store of value since world currencies decoupled from the yellow metal in 1971. That being said, even some market professionals are surprised to see that gold has significantly outperformed both stocks and bonds since 2000.

For those who embrace gold as a strategic asset, it remains for Gilded to make the case for acquiring and holding gold with us. We are grateful for the trust our current clients have placed in us. For those considering Gilded, there are three fundamental advantages we provide.

- Convenient, transparently priced access to physical gold acquisition, storage, and sale.

- Ownership of insured physical property stored outside the banking system.

- Ability to use physical assets as collateral through Gilded’s technology and network of financial services providers.

Buying, storing, and selling physical gold can be a cumbersome process. Gilded has assembled best in class providers across the value chain to make it easy. We ensure our gold is ethically sourced by working only with the most reputable Swiss refiners. The gold is always .9999 pure, exceeding the standards for good delivery set by the London Bullion Market Association. Clients transact at the LBMA fixing with no additional spread other than the transparent Gilded onboarding, storage, or offboarding fees. Clients have access to vault locations[1] across the Brinks network. This is a valuable feature for those interested in proactively managing geopolitical risk. Gilded’s transparent storage fees are based on order size and cover vaulting, insurance, administration, independent auditing, and verification. Sales are as straight forward as purchases. Gilded offers a process for bringing existing gold holdings onto the platform. Delivery can be arranged.

Gilded provides access to physical gold that is always the property of the client, which is stored in Brinks vaults that are insured by Lloyd’s of London outside the banking system. Physical property outside the banking system is not subject to bankruptcy as in the case of equities, default as in the case of bonds, or loss as in the case of bank or brokerage firm failure. This is superior to holding an ETF when it comes to protection against systemic risk. ETF investors own shares in an investment trust. These shares are inherently subject to counterparty risk and must be held at a financial institution inherently subject to failure. Furthermore, it is important to emphasize that Gilded does not offer a token or stablecoin. This is relevant given the destruction of wealth brought on by FTX and other crypto-related failures in 2022. The Gilded approach does not allow for use by Gilded of client funds because Gilded is neither counterparty nor custodian. Client gold belongs to clients. Period. In short, physical gold is one of the few highly liquid hedges against systemic risk available to the average investor.

In addition to the sound and secure structure in place for holding gold with Gilded, we have built a network of relationships and creatively deployed well-established technology to make gold useful. Gold held on the Gilded platform can be pledged to borrow cash enabling an investor to control the timing of capital gains while still accessing liquidity in times of need or opportunity. Again, physical gold is superior to an ETF in this regard, since the loan to value on a security is limited to 50%, while physical gold allows for LTV ratios in the order of 85%. Gilded has solved the “rock in a box” problem that has always posed an intellectual challenge to gold investors because an allocation to gold came with negative carry costs. Gilded enables investors to hold their gold and use it to earn a yield[1]. Another way Gilded clients can use their gold is to optimize tax gains and losses. US taxpayers in particular can take advantage of tax loss harvesting for physical assets which have different rules than for securities (wash sale rules), creating an asymmetric risk reward profile for clients

We welcome you to contact us for a discussion or to request research supporting any statements made above. In particular, “Gold in Pictures,” “Gold During Bad Times,” and “True Costs and Nature of Paper Gold,” are studies that may be of interest and are available to Gilded clients and investors in 2023

This article offers no predictions when it comes to the price of gold or any other asset, inflation, or any other economic indicator. Furthermore, the actions of policymakers in the face of these variables adds an additional layer of uncertainty. Experts are woefully inadequate when it comes to the direction and timing of the economy and financial markets. We view gold as a strategic asset valuable to hold in good times and bad, a steady ballast for most portfolios in an uncertain world. Now that Gilded has made gold functional, the case for an allocation to this strategic asset has never been more compelling.

[1] The Light Between Oceans, 2012.

[2] File:Janus coin1.jpg – Wikimedia Commons

[3] Here’s the one word from Jerome Powell that has people raising their eyebrows (cnbc.com)

[4] Bureau of Labor Statistics – Data Retrieval Tools

[5] CPI was 7.1 % (year-on-year) in June of 1982. [1] Fed’s Powell floats dropping “transitory” label for inflation | Reuters

[6] Fed’s Powell floats dropping “transitory” label for inflation | Reuters

[7] Goldman said Tuesday, November 16th, 2021, it expects the S&P 500 (^GSPC) to rise 9% to 5,100 by the end of 2022

The bull market will continue in 2022: Goldman Sachs (yahoo.com)

“Next year, we expect S&P 500 to reach 5050 on continued robust earnings growth as labor market recovery continues, consumers remain flush with cash, supply chain issues ease, and inventory cycle accelerates off historic lows.” Dubravko Lakos-Bujas, Chief U.S. Equity Strategist

2022 Market Outlook | J.P. Morgan Global Research (jpmorgan.com)

[8] Traditional 60/40 portfolio has actually reached its expiration date (cnbc.com)

[9] Subject to applicable law and regulations according to client nationality and domicile

[10] Contact Gilded for more information about the ways in which Gold can be pledged to earn a yield

ANY PROJECTIONS, MARKET OUTLOOKS, OR ESTIMATES IN THIS DOCUMENT ARE FORWARD-LOOKING

STATEMENTS AND ARE BASED UPON CERTAIN ASSUMPTIONS. OTHER EVENTS WHICH WERE NOT TAKEN

INTO ACCOUNT MAY OCCUR AND MAY SIGNIFICANTLY AFFECT THE RETURNS OR PERFORMANCE OF GOLD.

ANY PROJECTIONS, OUTLOOKS, OR ASSUMPTIONS SHOULD NOT BE CONSTRUED TO BE INDICATIVE OF THE ACTUAL EVENTS WHICH WILL OCCUR.