The value of money is eroding

Your returns shouldn’t have to erode too

Solutions for Institutional Investors

Inflation is no longer transitory and economic fundamentals may continue to push inflation higher for the forseeable future. With few smart alternatives to fiat currency, you need a bankruptcy remote, long-term store of value outside of the financial system.

Gilded’s World-Class Solution

Enables you to shift your cash allocation to gold and to enjoy the portfolio diversification benefits as well as the functionality and liquidity of cash.

Owning Gold on Gilded

Safe Harbor Potential with Superior Operational and Risk Management Capabilities

Owning gold on Gilded gives you access to ethically sourced, institutional quality gold that can act as a hedge against inflation, geopolitical events and macroeconomic uncertainty. But the benefits don’t stop there. By making gold digital, Gilded enables you to unlock the potential of gold as a useful alternative to cash.

01

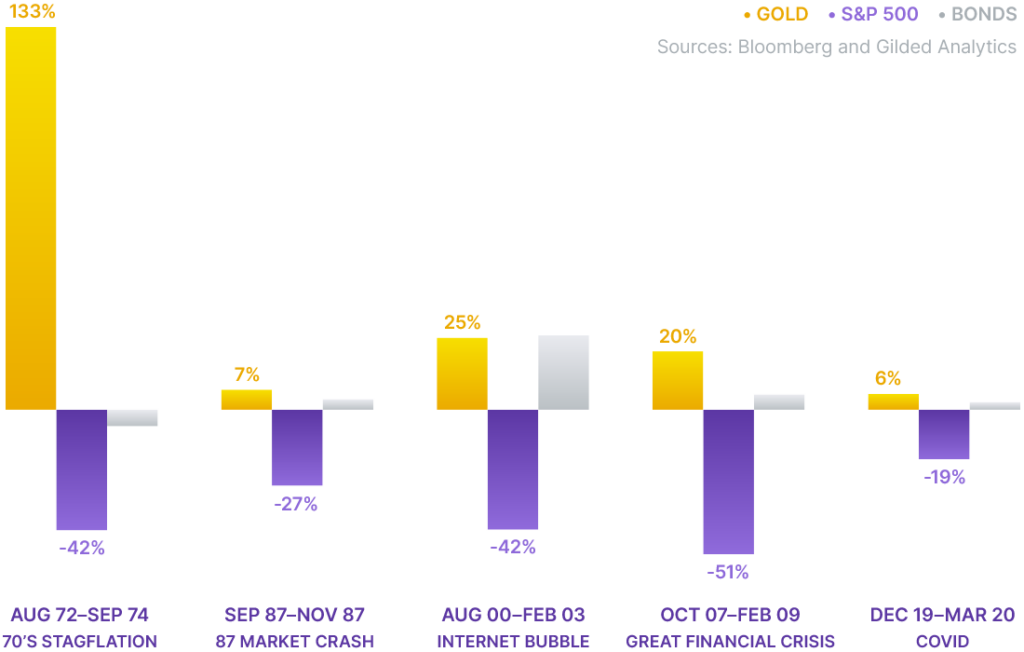

Offers tail risk protection opportunity without paying a premium

02

Introduces an uncorrelated asset to diversify portfolio returns and lower risk

03

Reduces the performance drag associated with cash while maintaining the ability to post initial margin

04

Provides prudent operational risk management in the event of Prime Broker/Futures Clearing Merchant instability or financial market disruption

Risk Management

Gold Offers

Tail Risk Protection

Gilded provides institutional investors with a bankruptcy remote solution offering operational risk management in the event of Prime Broker/Futures Clearing Merchant instability or financial market disruption. Achieve tail risk protection without paying a premium and reduce the performance drag associated with cash while maintaining the ability to post initial margin.

Comparisons

How Gilded compares to other investment choices

Gilded Gold

Outright Title

Gold ETF

Grantor Trust

Gold Funds

Securities

Gold Futures

Futures

Gold Stocks

Securities

Source: Gilded Analytics