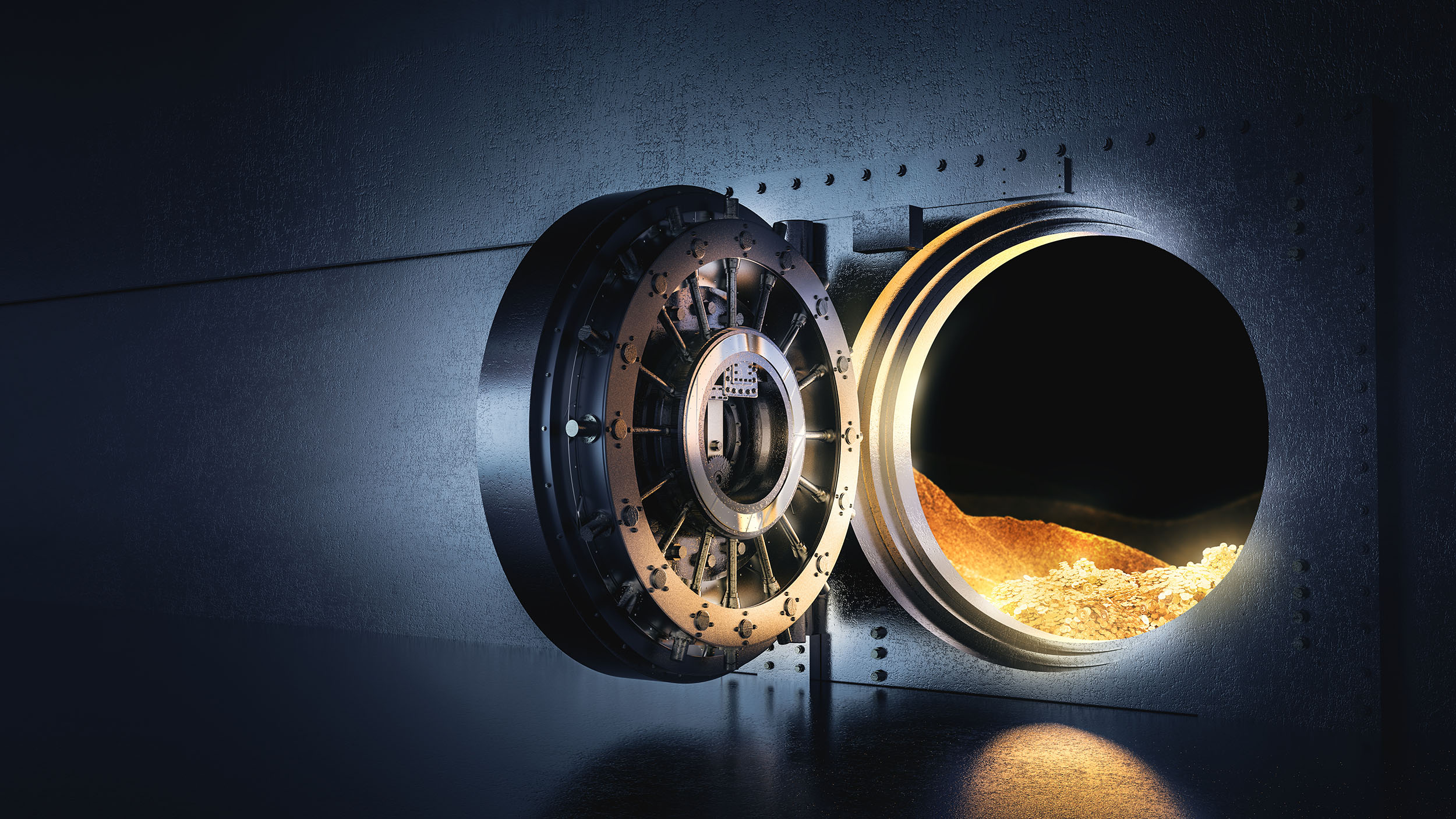

Impact your cash holdings and improve your returns with gold

Solutions for Family Offices

Inflation is no longer transitory and has the potential to continue to surprise markets on the upside. With few smart alternatives to fiat currency, your clients are looking for a bankruptcy remote, long-term store of value outside of the financial system.

Gilded offers a new solution, enabling your clients to shift their cash allocation to gold and to enjoy the portfolio diversification benefits as well as the functionality and liquidity of cash.

Owning Gold on Gilded

An innovative solution for your Clients

Owning gold on Gilded gives your clients access to ethically sourced gold that can act as a hedge against inflation, geopolitical events and macroeconomic uncertainty, but the benefits don’t stop there. By making gold digital, Gilded enables your clients to:

Borrow against their

gold holdings

Pledge their gold as collateral

May incorporate their gold into tax strategies

Comparisons

How Gilded compares to other investment choices

Gilded Gold

Outright Title

Gold ETF

Grantor Trust

Gold Funds

Securities

Gold Futures

Futures

Gold Stocks

Securities

Source: Gilded Analytics