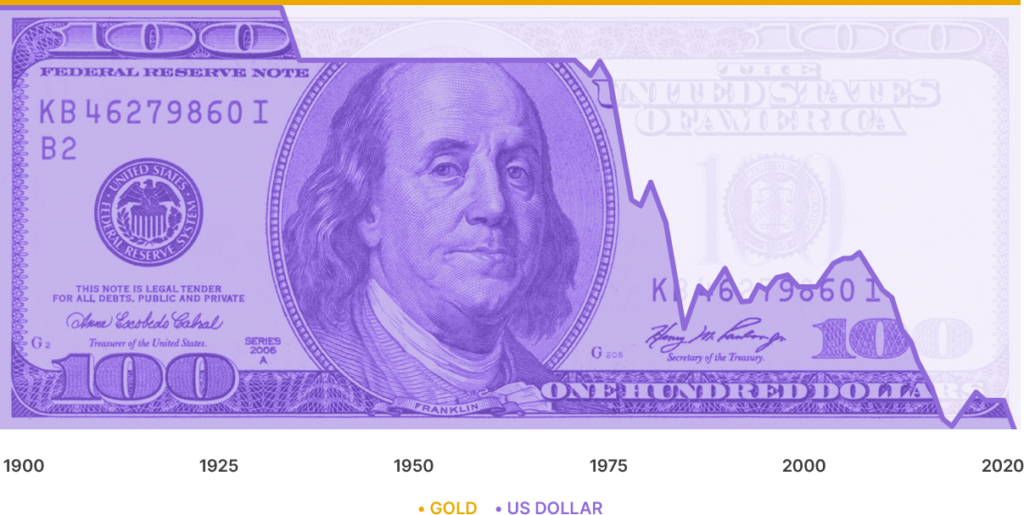

Gold vs. Cash

Gold vs. Cash

Over the last century, the U.S. dollar has steadily lost nearly 99% of its value against gold. For stability and asset reliability, gold is the superior investment choice over cash.

Steady Return In an Unsteady Market

Who holds cash these days?

From the corner store to the cornerstone of your investing strategy, we’ve uncovered a better option. Digital gold provides many of the conveniences we associate with cash and gives you control of your money.

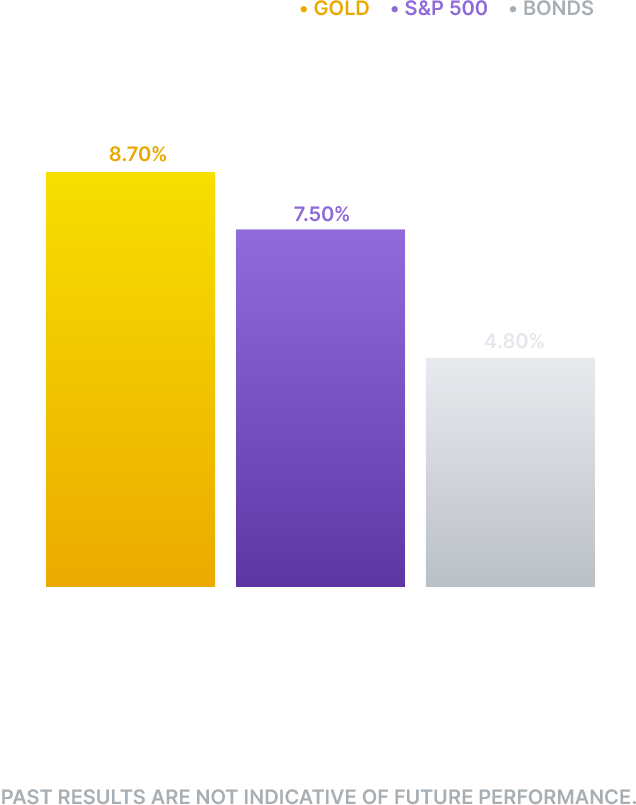

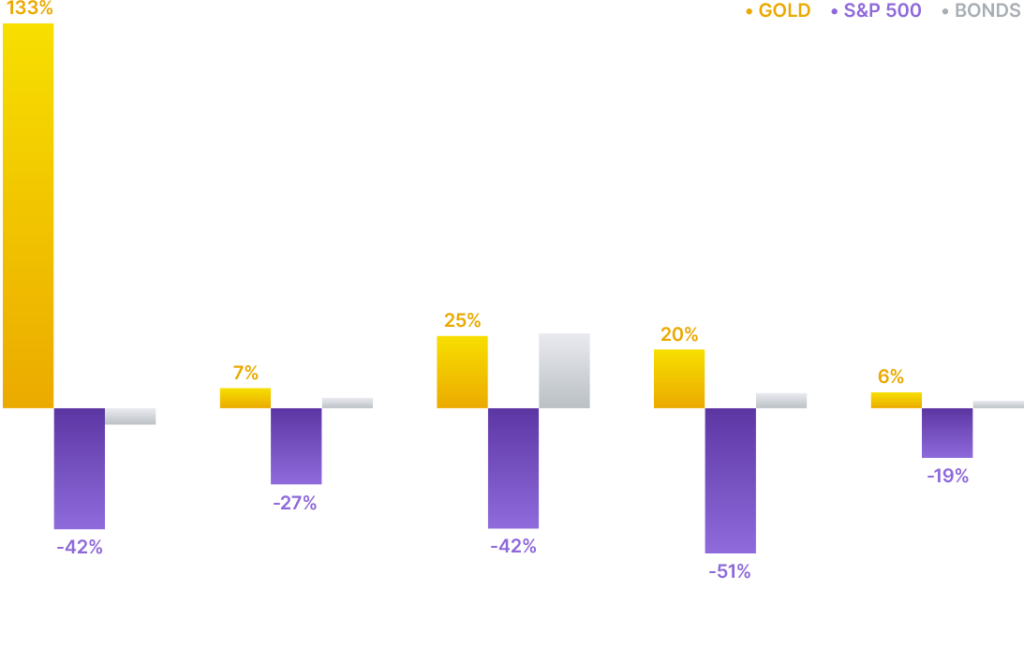

Unlike cash, gold has performed well under market stress. Gold represents an uncorrelated asset class with a history of compelling returns – outpacing equities since the turn of the millennium.

Inflation

Even small amounts of inflation continually erode the purchasing power of cash. Low levels of inflation over long periods substantially debase the value of cash.

Impact of Long-Term

Cash Holdings

High net worth investors often hold too much cash. Those cash investments are vulnerable, particularly in an inflationary environment.

Gold has historically outperformed stocks and bonds

A Case for Gold

Gold still represents the ultimate form of payment in the world. Fiat money in extremis is accepted by nobody. Gold is always accepted.

Alan Greenspan

Gold is money, everything else is credit.

J.P. Morgan

Gold. Safety during market uncertainty.

Start investing with Gilded now.