Research & Blogs

Market Returns: The Good, Bad, and Ugly 2022 Midyear and Post Transitory

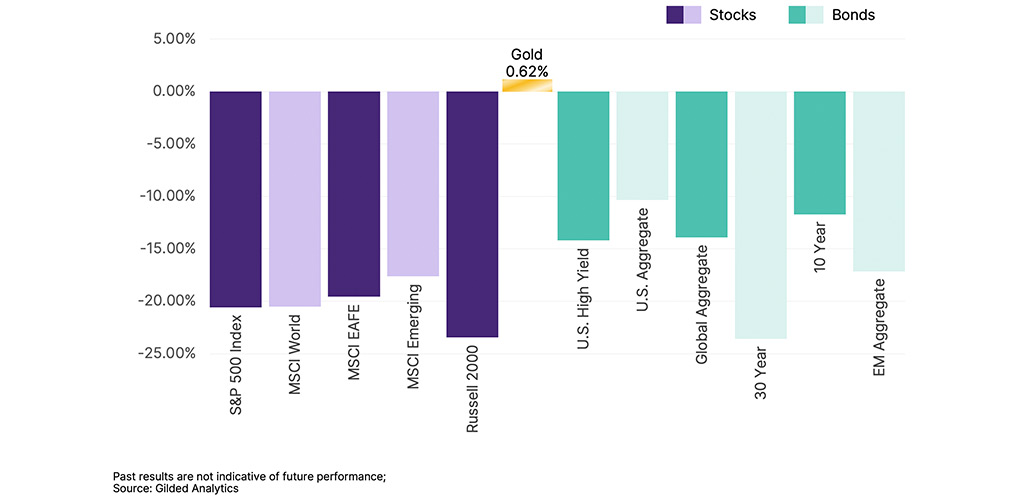

Year-to-Date Market Returns

With the first half of 2022 behind us, this is an appropriate time to reflect on returns and the relative performance of the asset classes that comprise many investor portfolios. Indeed, the markets broadly have struggled to adapt to the persistence of inflation and to the tardy but measurable central bank responses to this shift in the general level of prices. Bonds and stocks are down across the board.

With the main gauges of equity markets down significant (in the range of -20%) and bonds fairing little better (in the case of the benchmark U.S. 30-year bond, even worse), Gold has shone through as a bright spot with positive, albeit modest +0.62% returns for the year-to-date.

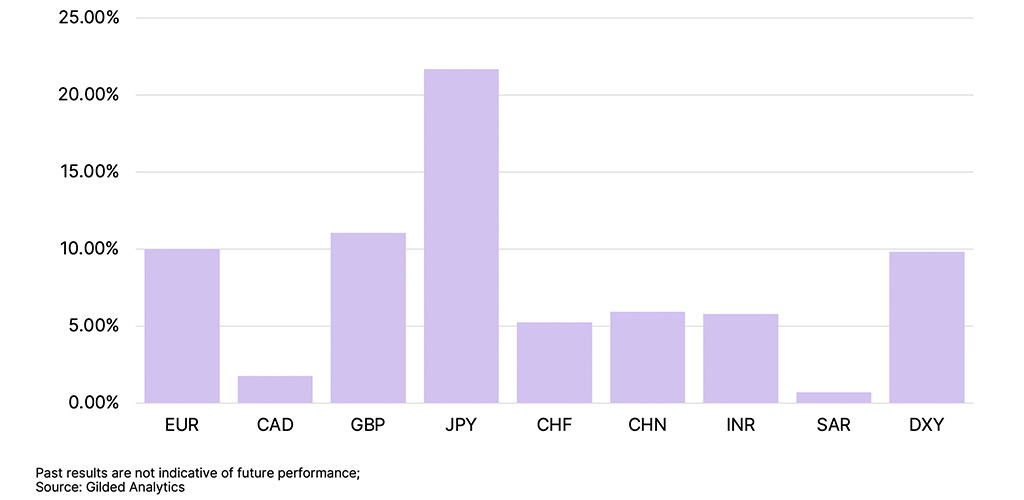

While some of this struggle across asset classes might stem from a delayed but significant response from central banks, it is hard to blame the bankers. Inflation is difficult to measure and even more difficult to predict. An example to showcase this comes from Federal Reserve Chairman Powell who introduced the word transitory to describe the pressure on prices in the face of the pandemic. But beginning in March of 2021, unexpectedly high levels of inflation have persisted through today.

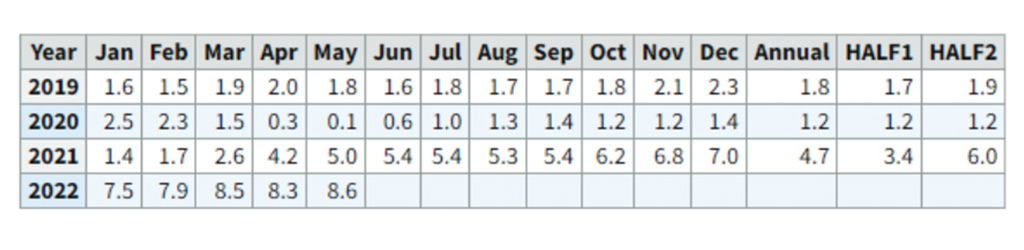

Transitory is not so Transitory

On November 30, 2021, after nine months of inflation levels not seen since 1981, Chairman Powell decided to drop the word, offering that, “transitory is no longer the most accurate term for describing the nature of the current high inflation rate.” Investors no doubt agree.

So, for Fed watchers and those market participants that defer to policy makers despite the uncertainty of their work, it also makes sense to consider asset class returns from the time the professionals recognized inflation as a problem.

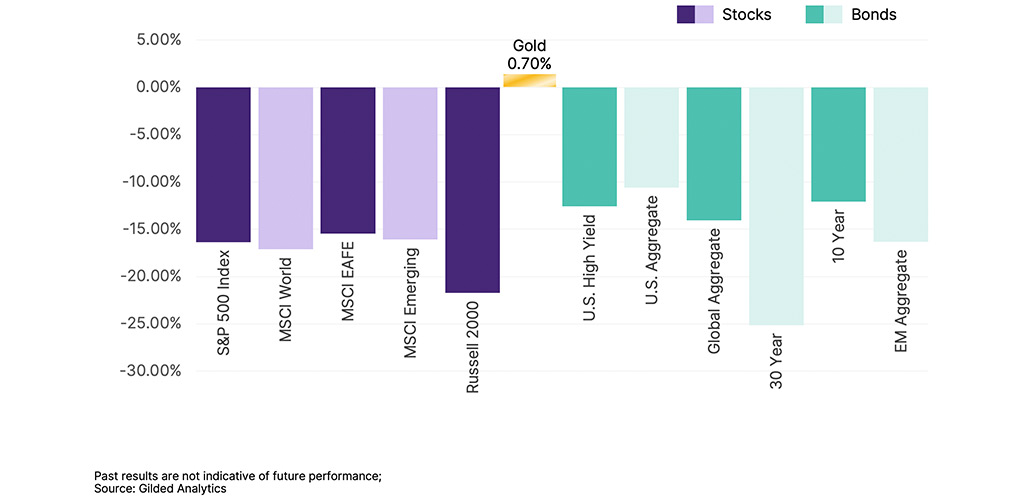

Here, the picture is no rosier, and again gold is the standout positive performer. However, despite relative outperformance of over 20% compared to equities, skeptics will question why gold failed to perform even better in the face of inflation. The answer might be that IT DID!

Gold Returns in a Down Market

Through the lens of most currencies that are not the USD, gold has proven a haven in the face of unexpected inflation with significant positive returns shown in the accompanying chart.

Without question this is a difficult time to expect positive returns for most asset classes, yet periods of stress and uncertainty like this are to be expected. In the face of this reality, the prudent investor tries to rely on diversification to mitigate the damage a period like this can inflict on a portfolio.

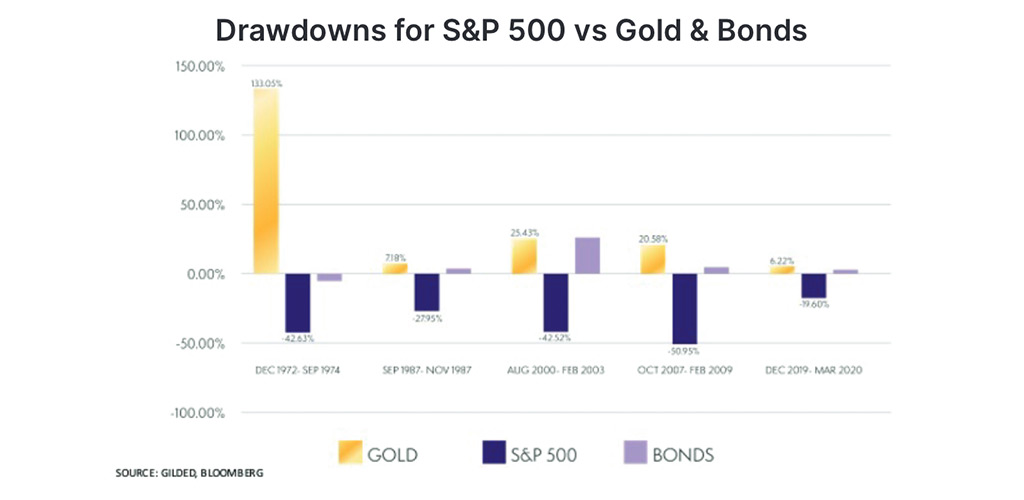

Gold is again proving to be the type of uncorrelated asset that can provide ballast when every other asset class is moving in the same direction. This is not a new development.

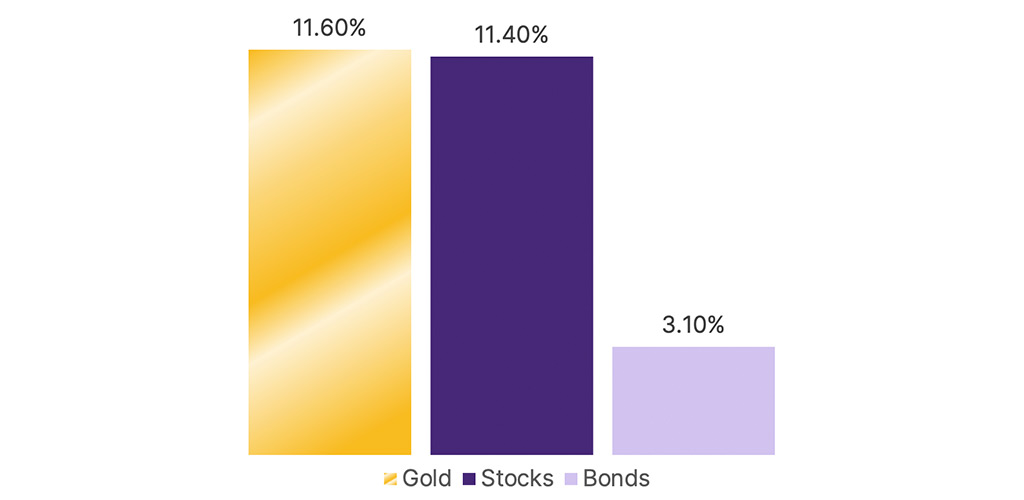

Gold has consistently outperformed returns relative to equities and bonds during periods of unexpected inflation as can be seen from data going back to 1913. Moreover, during periods of significant market stress, gold has proven a valuable safe haven in terms of portfolio diversification. In 1987, when stocks crashed, gold outperformed, yielding returns over 35%. Following the Internet bubble at the turn of the millennium, gold outperformed stocks with returns more than 65%.

During the Great Financial Crisis of 2007-2009, gold outperformed stocks with returns over 70%. And at the onset of the COVID pandemic in late 2019, gold outperformed stocks with returns over 25%. Today, we find ourselves in an uncertain period where even the professionals and policy makers are struggling to figure out the extent, duration and potential consequences of higher-than-expected inflation. Diversification is prudent protection for a portfolio in times like this, diversification that gold has offered in the past and again today.