Research & Blogs

LBMA Gold Price

The LBMA (London Bullion Market Association) Gold Price is considered the global benchmark price for unallocated gold delivered within the London network.

The ICE (Intercontinental Exchange) Benchmark Administration facilitates the price and creates the auction platform by which the LBMA Gold Price is calculated. The ICE platform is 100% electronic, tradeable, auditable, and follows the IOSCO (International Organization of Securities Commission) Principles for Financial Benchmarks. This means that any party leveraging the LBMA Gold Price in any format requires a usage license with IBA (Indian Bankers Association).

The LBMA Gold Price is utilized by producers, banks and central banks, fabricators, jewelers, investors, and market participants around the globe. They all transact during the IBA Gold Auctions and leverage the benchmarks as a means of reference for the price.

There are several reasons why the ability to reference a single price offered by a regulated benchmark administrator like LBMA provides major benefits. For example, the LBMA Gold Price facilitates spot, cash-settlement, monthly averaging, location swaps, and other derivative transactions crucial for price risk management. The LBMA Gold Price helps significantly in these areas; therefore, it has become a widely accepted reference point throughout the marketplace.

Importance of LBMA Gold Price

The LBMA Gold Price Benchmark serves as a reference for most unallocated gold entering the London market. By this benchmark, evaluators can appropriately price the gold depending on the time of auction. This systematic process is conducted to ensure the accuracy of the gold price to ensure a proper valuation of the bar or bullion. The London gold marketplace counts on the LBMA Gold Price to fairly and accurately price all gold needed for valuation.

How Does It Work?

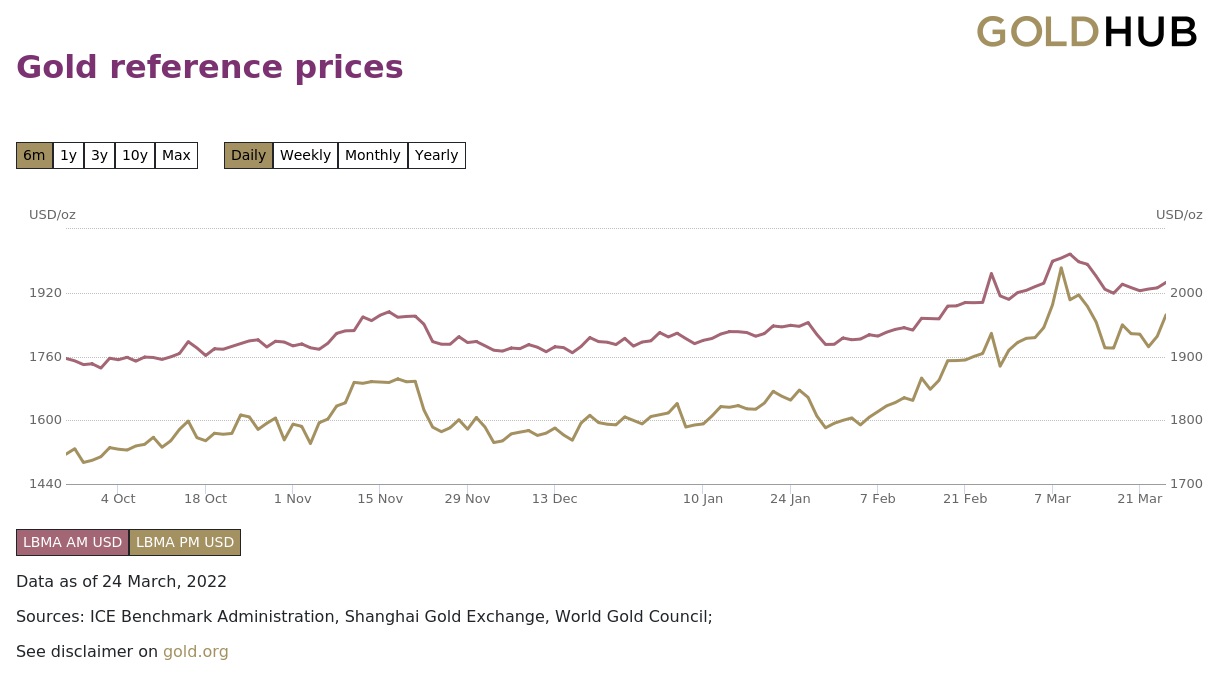

IBA conducts electronic auctions for spot, unallocated local London gold, which provides a market-centric format for buyers and sellers to trade. The auctions occur twice daily at 10:30 AM and 3:00 PM London time for gold. After that, the final auction prices are listed on the market as the LBMA Gold Price AM and PM. The currency format for the price information is rendered in U.S. Dollars per fine troy ounce and per gram; however, IBA also publishes the benchmarks in Pounds and Euros.

Source: World Gold Council “God Spot Prices” https://www.gold.org/goldhub/data/gold-prices

Where Can You Find the LBMA Gold Price Benchmarks?

The LBMA Gold Price Benchmarks can be accessed from several data vendors. These vendors include Thomson Reuters, SunGard, ICE Data Services, FastMarkets, Bloomberg, SIX Financial Information, and Class Editori S.p.A.

The IBA is solely responsible for guaranteeing appropriate governance over the LBMA Gold Price Benchmark to ensure the expected level of standards is met every time. The IBA operates through a strict code of conduct to which all participants must adhere.

Licensing

There are also several types of licenses for the LBMA Gold Prices. The first is the Usage License which is required for any institution that uses the LBMA Gold Prices in valuation and pricing activities. Another is the Redistribution License, required for any party redistributing the LBMA Gold Prices to third parties. Next is the Historical Access License, which is necessary for all parties wanting access to consolidated monthly historical price files and transparency report data from the IBA central database. Lastly, the ETP Issuer License is required to issue ‘ETPs’ or exchange-traded products, such as a gold ETF.

How Gilded Leverages LBMA Gold Price

All gold orders made through the Gilded platform are traded at the current LBMA Gold Price plus the transaction cost. Regardless of the quantity of the order, Gilded leverages the LBMA Gold Price to execute every gold order placed within its solution. The LBMA Gold Price is vital for ensuring gold purchased within a specific timeframe is accurately priced. Gilded trusts the LBMA Gold Price as a reference point by which the gold it sells is evaluated against. Without it, there would be no standardized, universally accepted method for accurately pricing gold bars. Gilded relies on the LBMA Gold Price to provide transparency and accuracy at the end of every AM and PM auction, which dictates the price of gold for that window.