Research & Blogs

Growth Stocks and Gold – Yielding Returns without Earning a Yield

For several reasons, gold has received considerable criticism in the financial media space, especially since cryptocurrencies entered the scene. When gold is included in investment discussions compared to stocks and bonds, it often is criticized for not paying a dividend or interest. This is technically true; however, not all stocks pay dividends. The ‘argument’ implies that gold is inherently inferior because it does not pay dividends or interest. However, this argument dodges many important points. We will highlight a few.

Dividends on stocks are a means by which companies return capital to shareholders. When things are going well, typically evidenced by its business(es) generating a profit, a company may pay out a certain sum of money per share. Companies could opt to ‘pay’ with stock instead, but ‘stock dividends’ are often reserved for special circumstances. Bonds are a contract between borrowers (debtors) and lenders (creditors) that stipulate loan terms: periodic payments at a certain interest rate and, eventually, when the loan is to be repaid. Bonds can have many different permutations, but that is the idea in general.

The applicability of similar financial yardsticks to gold and stocks or bonds essentially begins and ends with how the capital invested in each has performed relative to the capital invested in the others. After that, it is asking too much of gold to do things it cannot possibly do. Like paying a dividend or interest, for example, which is made possible by commercial activity when paid by a company. Gold is simply gold, not Gold Inc. or Gold LLC. When a government pays interest on bonds, the money usually comes from “raising revenue,” otherwise known as taxation, or issuing more bonds when other sources are exhausted. Gold is not the United States of Gold or the Republic of Gold.

Dividends are not the financial equivalent of Kevlar. Any dividend-paying company can suffer a reversal of financial fortune, for whatever reason, and resort to reducing or eliminating dividends, among other cost-cutting measures. For example, dividend cuts or cancellations globally in Q2-Q4 2020 due to the COVID-19 pandemic’s impact on economic activity amounted to $220 billion. A $2 per share dividend is ideal when it is paid. However, it is likely to be of little solace when the stock of the company paying it could fall multiples of $2 as a reflection of its business prospects worsening. Even less solace if reduced from $2 – and no solace at all if it is cut altogether.

Bonds issued by companies, and in some cases, even by countries can also be somewhat tricky when their issuers find themselves in dire financial straits. The remedying process typically begins with a ‘restructuring’ that could entail lowering the rate of interest paid or an extension of the date when the debt is to be paid off. Or both. Bankruptcy could be the endgame when all other proposed remedies fail. In that event, bondholders could find themselves in the position of having to seize assets to recover some, but likely not all, of the money they lent. Alternatively, they could opt for a debt-for-equity swap. Creditors holding $27.0 billion worth of General Motors bonds went that route when the company declared bankruptcy in June 2009, accepting an equity stake in the “new GM” worth a pittance compared to what they initially lent.

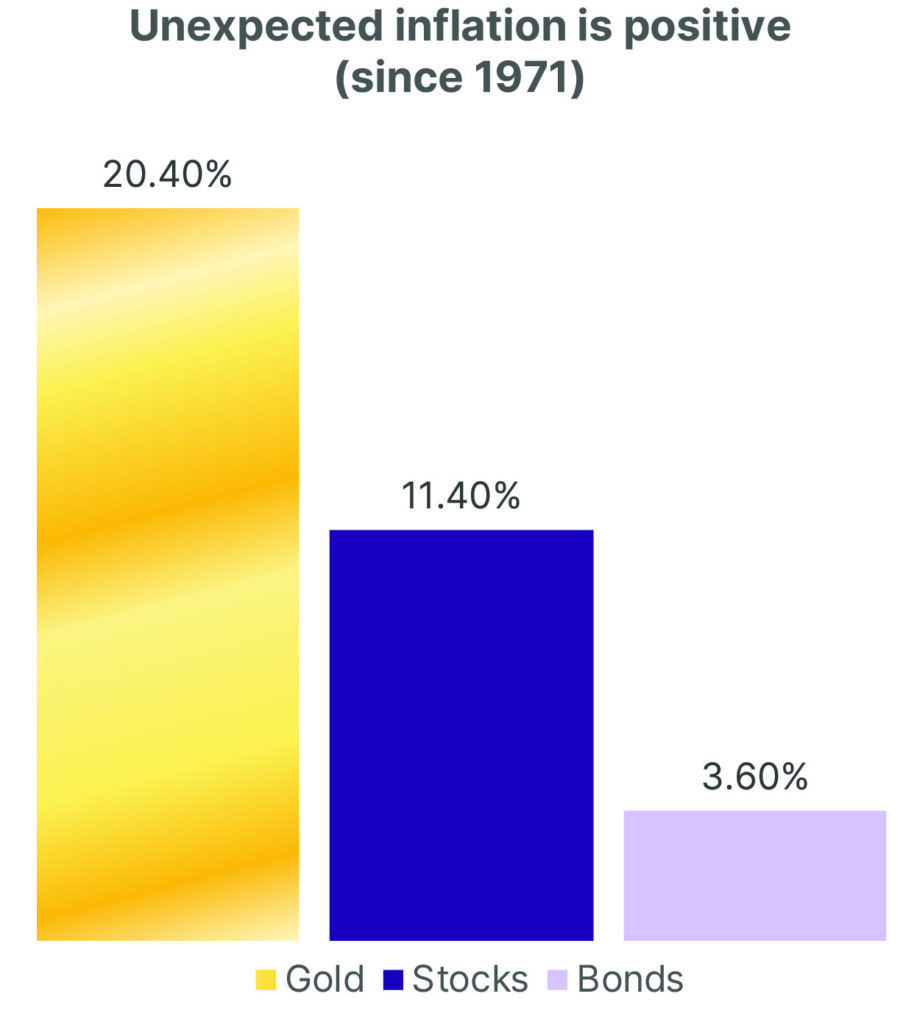

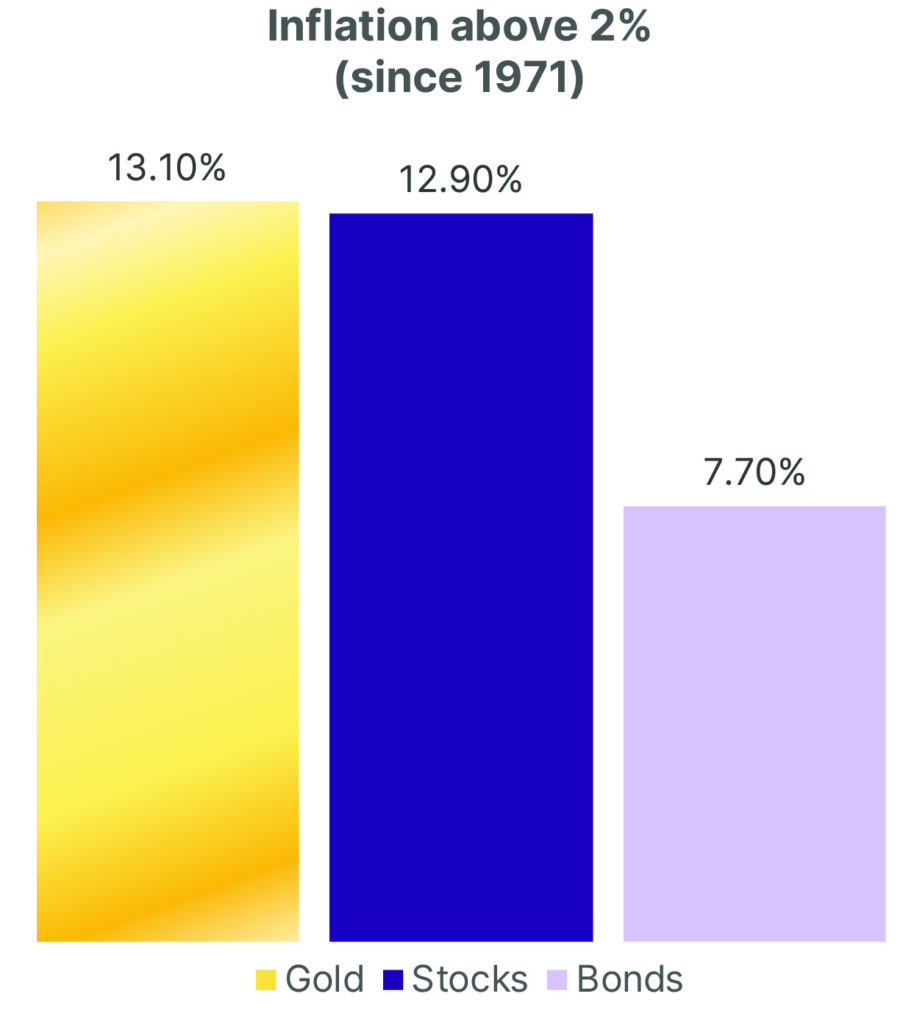

The argument that gold does not pay a dividend does not reconcile well with stocks such as Amazon.com, which returned a little over 30% per year to shareholders in the decade to November 2021 despite not paying any dividends. Or Alphabet (Google) stock, for that matter. Taking inflation into account, especially when it is unexpected, often goes unaddressed, too. Unless accompanied by compensatory appreciation in the underlying stock or bond, a 2.0% cash dividend or a 3.0% interest rate in an environment where inflation is running in excess of those rates is not keeping up with a rising cost of living.

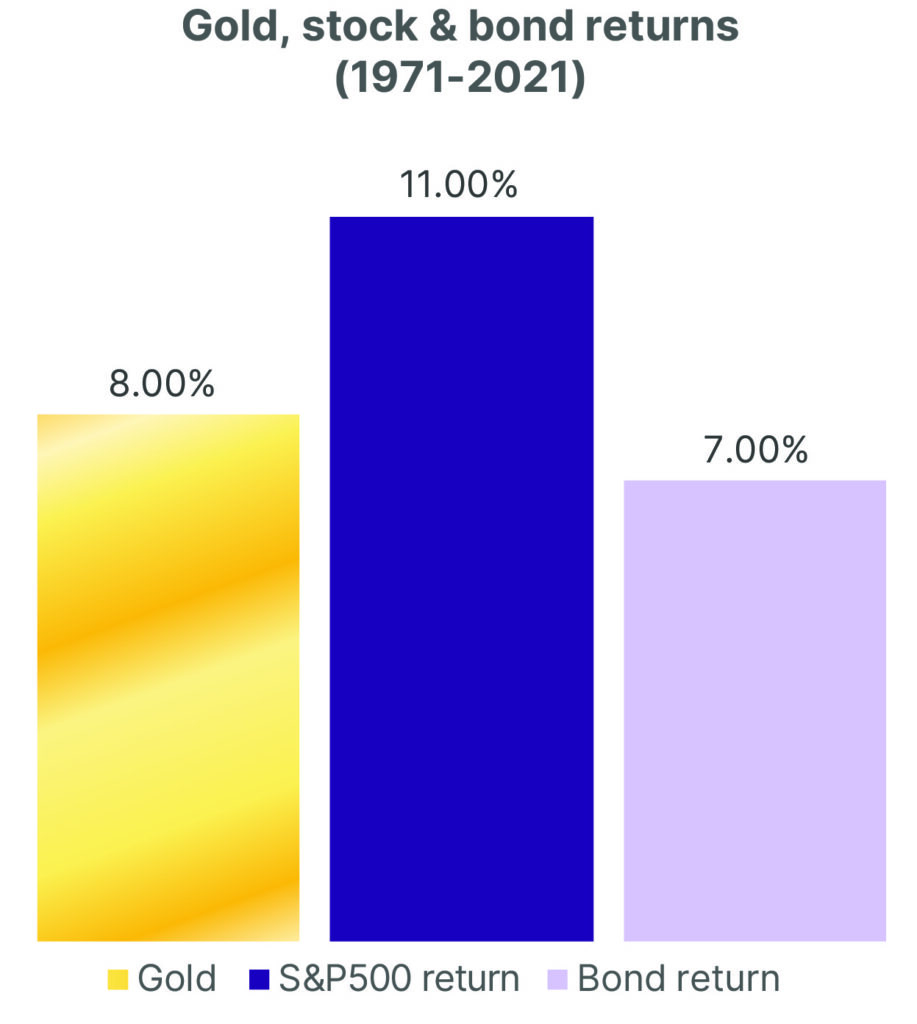

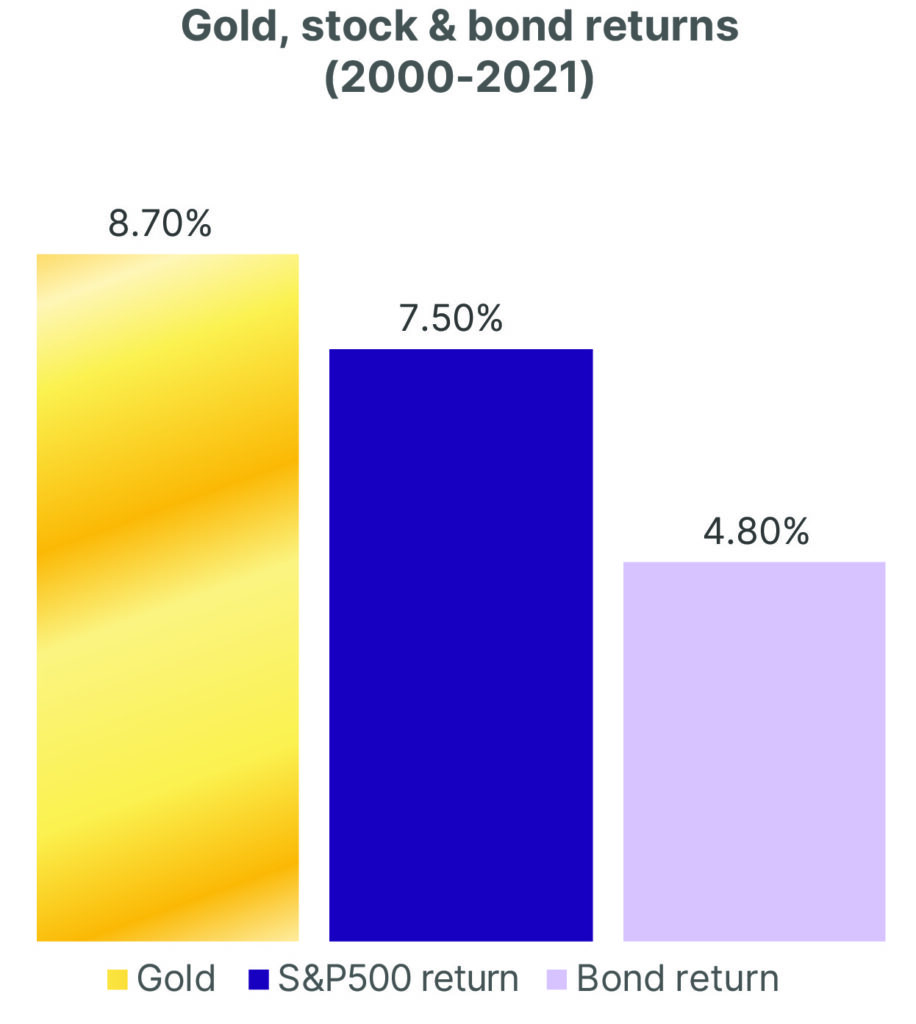

Time and space limit the scope of every debate, especially when the subject matter can be complicated, like assessing the pros and cons of different investments. If investors want to evaluate gold versus stocks and bonds, they should also consider how it can act as an inflation hedge and store value for a complete picture. Not paying a dividend or interest does not disqualify gold from consideration as an investment vehicle. Moreover, although most may avoid directly comparing the pros and cons of gold to that of stocks and bonds, it is worth mentioning that gold has a lot less baggage that comes with it. Companies that issue stocks can go bankrupt. Bond issuers can default. Gold’s immediate benefits are evident and not tethered to the same headaches that confront stocks and bonds, unlike stocks and bonds. Physical gold is always your property, bankruptcy-remote, and outside the banking system. Since global currencies decoupled from any metallic standards over five decades ago, gold has continued to serve as a stable store of value.