Research & Blogs

ETF Advice for Advisors Recommending Gold as a Portfolio Allocation

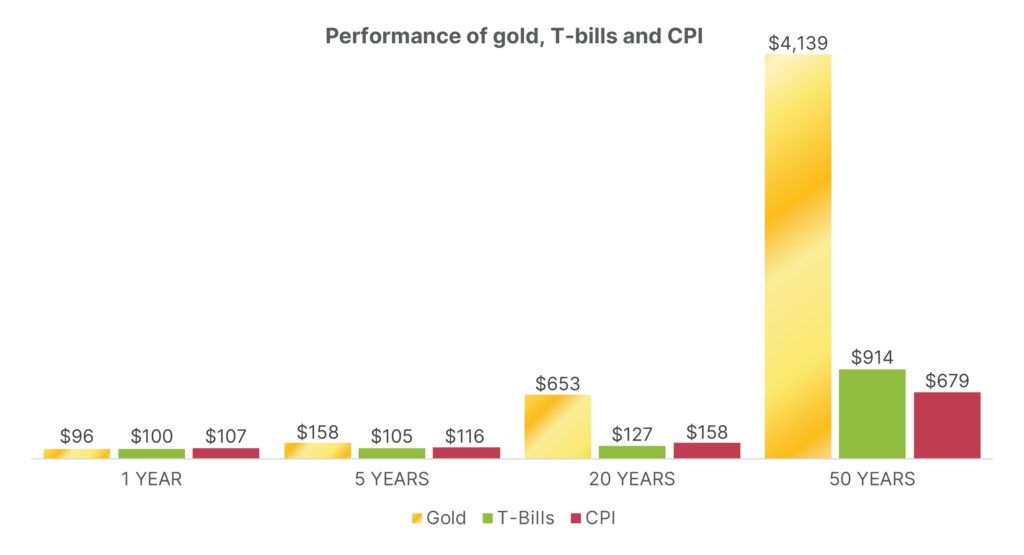

You’ve decided to advise your clients that gold deserves a portfolio allocation. Gold has a history of compelling returns – outpacing equities over the last two decades and vastly outperforming bonds, bills, cash, and inflation. Gold is uncorrelated to both stocks and bonds, so adds diversification that lowers portfolio volatility. And in times of significant market stress, gold has shown resilience while other risky assets suffered sharp declines. With the decision made, now comes a choice as to how the clients will access their exposure to gold. The popular gold ETFs offer an accessible choice, but is this the best way for your clients to own gold?

It might be. If the client wants short-term exposure to gold in anticipation of some geopolitical or other idiosyncratic event, the ETF is indeed a reasonable and cost-effective option. If, however, the client plans to hold gold as a long-term portfolio allocation, is concerned with the possibility of systemic financial risk, or is sensitive to tax events, then further consideration is warranted.

First, let’s consider what your client gets when they purchase shares of an ETF. They get shares in a grantor trust in the form of a security that derives value from an unallocated pool of gold and cash designed to replicate the price movements of gold. Clients do not get allocated physical gold. Fees charged by the trustee reduce the amount of gold that is held by the client. In a scenario where the price of gold remains unchanged indefinitely, a clients’ holding will eventually be worth zero. This dynamic makes the ETF unsuitable for a long-term allocation.

With the popular ETFs, there is no guarantee that a client can redeem shares for gold. The gold holdings of the fund might not match the shares purchased by investors. For example, the Blackrock (iShares) managed IAU prospectus states, “The assets of the Trust consist primarily of Gold held by the Custodian on behalf of the Trust. However, there may be situations where the Trust will unexpectedly hold cash.” This can lead to a tracking error where the performance of the trust does not exactly follow that of gold spot.

The gold is not insured as it moves from sub-custodian to custodian. The State Street managed GLD prospectus mentions that, “Because neither the Trustee nor the Custodian oversees or monitors the activities of Sub-custodians who may temporarily hold the Trust’s gold bars until transported to the Custodian’s London vault, failure by the sub-custodians to exercise due care in the safekeeping of the Trust’s gold bars could result in a loss to the Trust.” The safety of the shares relies on the effective management of the trustee of the investment pool and the flawless execution of duties by various custodians and sub-custodians. Furthermore, should the Trustee run into financial distress, holders of ETF shares have counterparty risk that becomes an unsecured claim of the bankruptcy estate.

On top of this, the shares of the ETF once purchased must now be held at a brokerage firm within the financial system. Imagine for example that in 2008, a client seeking an investment in gold to hedge against systemic risk had purchased an ETF managed by Bear Sterns and held in a brokerage account at Lehman Brothers? Of course, Blackrock and State Street maintain sound reputations, but the prudent advisor should consider the risk that clients may not recognize but will appreciate if financial firms or the financial system faces severe stress.

When it comes to tax treatment, it is important to keep in mind that taxable investors holding an ETF may get a tax bill even if they do not sell shares for a capital gain or loss. As holders of a grantor trust any income or losses accrue to the investor. The IAU prospectus states explicitly that investors are “viewed as if they directly received a corresponding share of any income of the Trust, or as if they had incurred a corresponding share of the expenses of the Trust. Consequently, each sale of gold by the Trust constitutes a taxable event to owners of beneficial interests in the Shares.” This type of structure keeps accountants busy at tax time and some investors confused when they receive a tax bill without having traded the instrument.

Gilded offers fully allocated physical gold that is bankruptcy remote and held outside the banking system in fully insured Brinks operated vaults at a regulated location of the client’s choosing. Delivery can be arranged. Timing of taxes can be controlled and optimized by the individual investor. Fees are structured so that gold holdings are not reduced over time. The ETF may be the easy choice, but when it comes to investing in gold, you get what you pay for.