Research & Blogs

Does Your Portfolio Include Gold? It Should.

Financial investors know gold as an asset, but not all investors currently have any in their investment portfolios. In many cases, they probably should. The purpose of this post is to tackle the question of whether to incorporate gold in a typical portfolio. Evidence would suggest that the answer is yes based on a handful of compelling reasons, each supported by Gilded Analytics research.

The Future Is Unpredictable

Why are portfolios necessary? With perfect information about the future, an informed investor simply needs to identify the asset that will increase most in value, dedicate all available funds to that single asset, then sell it before it declines and repeat.

Unfortunately, no one can predict the future performance of any asset. Investing is a tough business, so difficult in fact that according to a CNBC study, 92% of active managers underperformed their benchmarks over a 15-year period. If even 9 out of 10 professionals armed with technology, real-time data, research support staff, and preferential liquidity fail to beat the market, where does that leave the rest of us? This is where portfolios enter the frame.

Picking The Right Investments Can Be Difficult for Your Strategy

Since even the professionals can’t consistently pick winning investments, creating a mix of assets, investing in them over time, and holding them for the long term has proved a reliable solution. The general idea to mix asset classes like equities that have historically offered higher long-run average returns with other assets classes like bonds that tend to be more stable and real estate or alternatives that tend to be less liquid has offered consistent returns over time.

One might consider investing everything in a broad portfolio of equities, but that may not always be the best course of action. This is because risky assets can fall just as quickly as they can rise. Significant stock market corrections tend to occur with a surprising degree of regularity.

As an example of what can happen during a stress event, if an investor saving for their twin children planning to attend college in the Fall of 2008 chose a 100% equity portfolio, the $200,000 they had amassed by September 19th would have declined to less than $128,000 by October 10th, 2008.

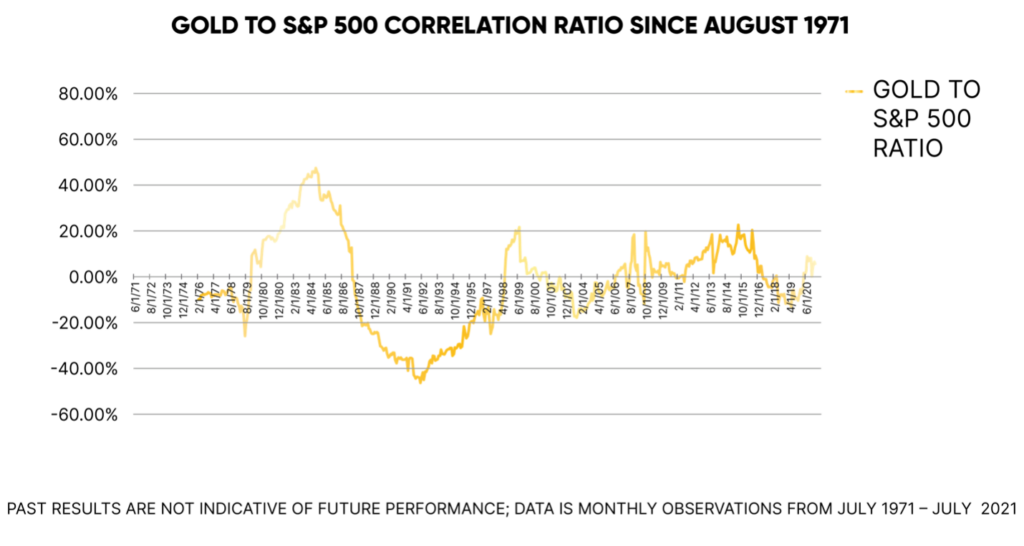

That could spell trouble for at least one of the twins. This is where diversification comes in. By including assets that tend to remain stable when stocks decline or, better yet, tend to rise in value when markets crash, the investor can rest assured knowing they will be able to pay for both child’s tuition. Gold has historically been one of those special assets. The chart below shows how the prices of gold and stocks move independently.

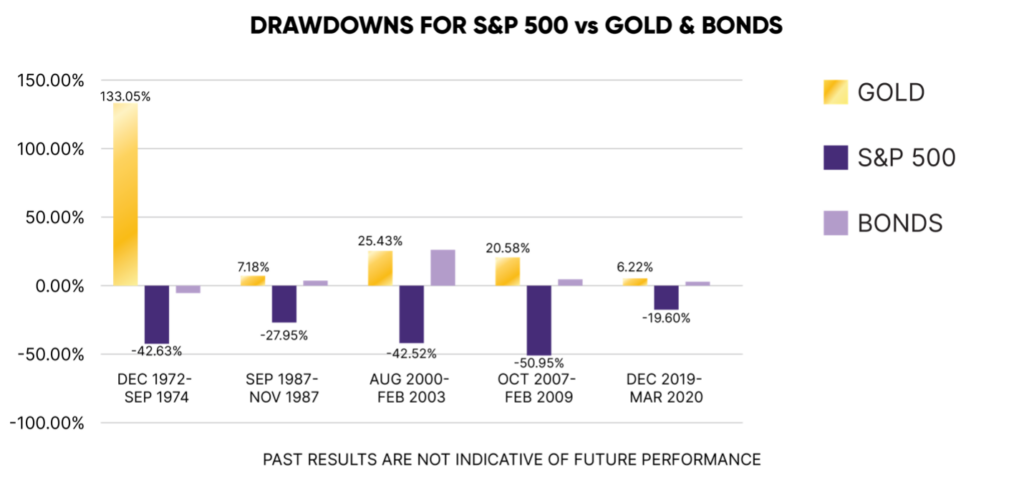

Even more revealing, gold tends to perform well when the rest of the world is in disarray. This was true during the stagflation of the early 1970s, the stock market crash of 1987, the Internet Bubble of 2000, the Great Financial Crisis of 2008, and just recently, as COVID took hold of the economy in early 2020. So, when most of the other things an investor owns, like stocks in their 401k or their house, are declining, gold offered shelter from the storm, an asset that increased in value to offset losses in other areas.

How Does Gold Fit in Your Portfolio?

First, diversification is nice, but investors still need assets that appreciate over time. Gold possesses some interesting characteristics as both a commodity and as money, which can help explain why it may increase value in good times and bad.

In an ideal economic scenario, jobs are plentiful, and incomes are sufficient to meet needs, save a bit and provide for some indulgences.

For centuries, jewelry has been a popular indulgence. Gold also has industrial uses in dentistry and technology. Most smartphones have small amounts of gold integral to their manufacture and function.

So, when times are good and more people buy jewelry, new mobile phones, or fix their teeth, this additional demand for gold creates an economic force that puts pressure on prices to move higher. Other economic forces to consider, such as supply, may offset those pressures, but this logic nonetheless holds. During downturns, the world migrates from risky investments to consistent quality assets like US government securities and gold. At times like these, gold prices tend to rise.

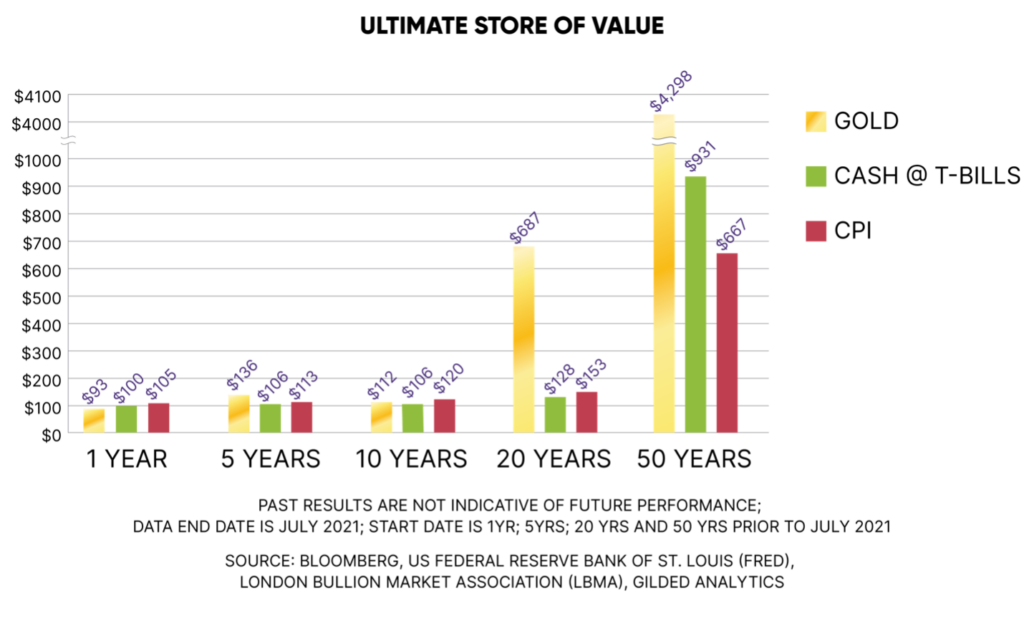

As shown in the chart below, the returns on gold have consistently outperformed inflation and T-bills over long periods. Of course, over short time horizons, that can vary. Gold prices can indeed decline. Nonetheless, gold has been a reliable store of value for centuries. The period since world currencies came off the gold standard 50 years ago is particularly relevant since coordinated manipulation by central banks artificially influenced the price of gold before that time.

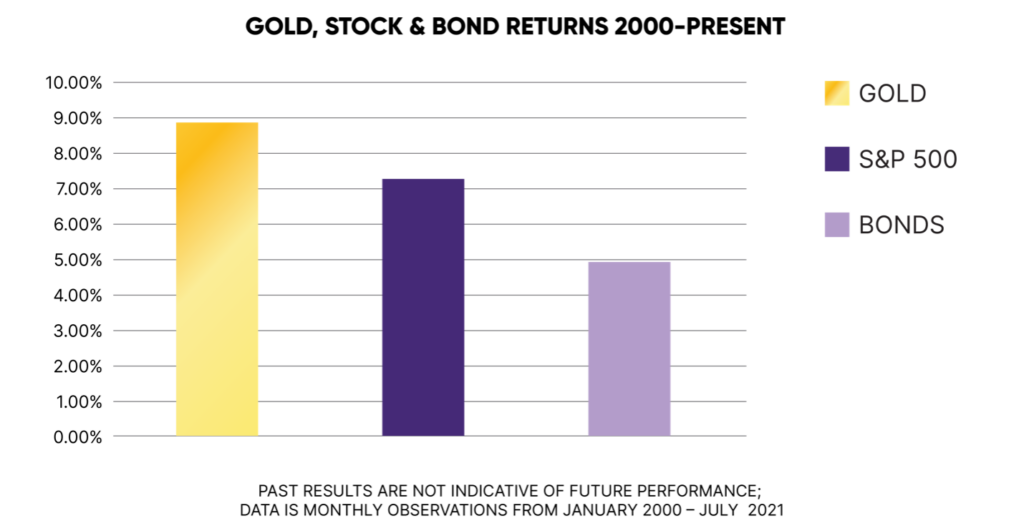

In speaking, even with experienced investors, many are surprised to hear that gold returns have kept pace with equity returns since the introduction of the Euro currency at the dawn of the millennium.

The chart below shows this outperformance; however, in sharing this data, three factors must be emphasized:

This is not a suggestion that gold will continue to outperform equities. The best estimate for long-run returns on gold and equities remains their historical averages of 7.92% and 11.02%, respectively.

Gold moves in both directions. What goes up can certainly come down. Market professionals refer to this movement as volatility. And while gold volatility tends to average around 14.9%, this remains significantly lower than stock market volatility of 18.5%.

Regarding asset allocation, the suggestion here is less about changing investments to other risky assets and more about holding less cash.

Gold’s Bottom Line

To summarize the ideas touched upon here thus far:

Gold offers a compelling store of value over time, with returns consistently higher than inflation and short-term bonds

- Gold is less volatile (risky) than equities and uncorrelated with stocks overall.

- Gold tends to perform particularly well when things are going particularly poorly for the rest of the world – investment professionals call this “right way risk,” “tail risk protection,” or “flight to quality.”

- Gold is one of the most actively traded assets globally, so it is among the easiest to liquidate when necessary.

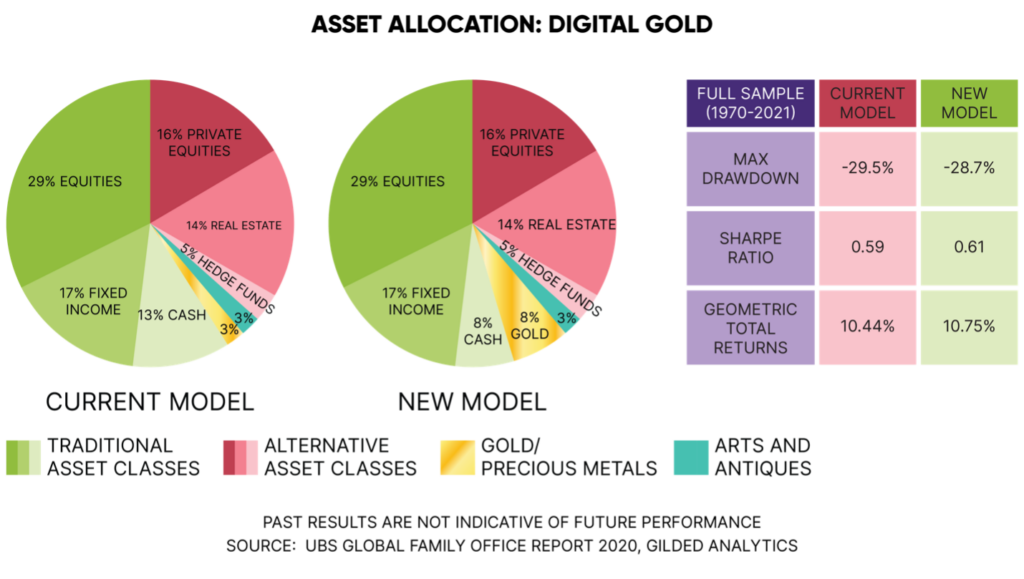

With these factors in mind, research performed by Gilded Analytics examined the returns on a typical high net worth portfolio to study what would have happened if the amount of cash held was reduced by 5% and redirected to gold, netting an allocation of 8% to the metal. This 8% is within the range of prevailing suggested allocations to gold among investment advisors. The chart below shows higher overall returns with less risk (higher Sharpe ratio) and a lower loss in times of stress.

Why Hasn’t Your Advisor Suggested Gold?

Many investors have already identified the benefits of having gold in their portfolios. A recent study by Greenwich Associates finds that 27% of sophisticated institutional investors with $10 billion or more in assets under management use gold in their portfolios.

More than two out of three central banks worldwide count gold among their top three reserve holdings. But don’t blame your financial advisor just yet. In the past, investing in gold, especially physical gold, always posed challenges.

Gilded solves the traditional problems of varying quality, storage, transporting, and selling gold. With these issues resolved, investors have another tool at their disposal to ensure that their portfolios can keep them afloat despite the state of the markets.