Research & Blogs

Holding Cash: An Advisor’s Guide to the Problem of Cash

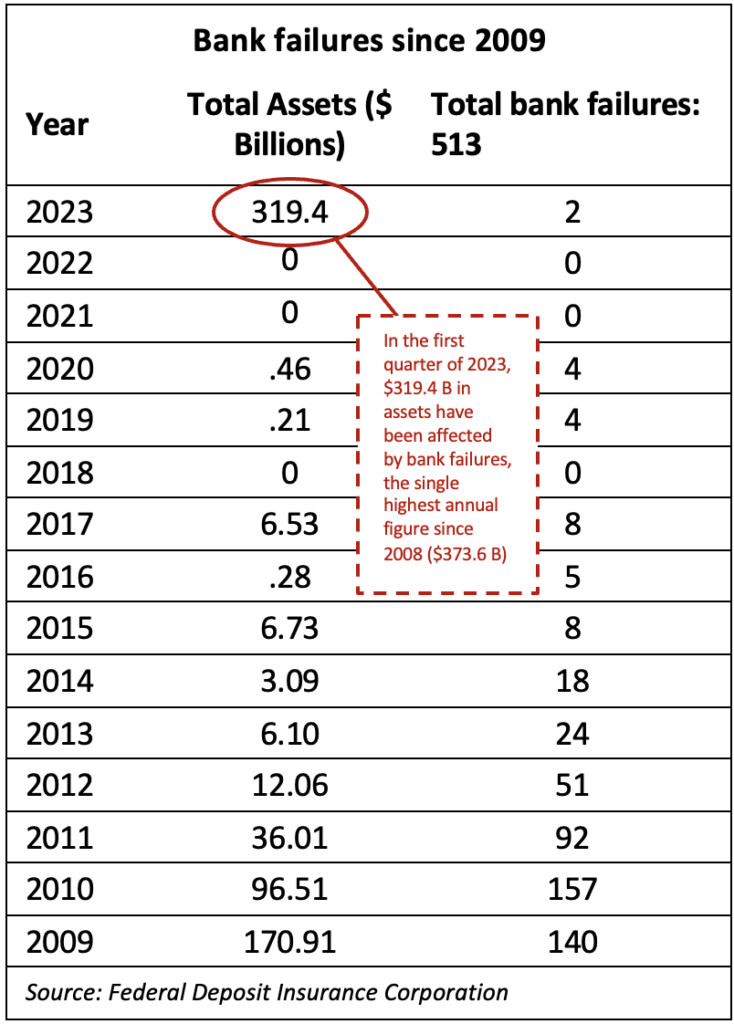

Update: Gilded originally published this blog in April 2022. The recent failures of Silicon Valley Bank, Signature Bank, and Silvergate Bank merit revisiting this research. One reason Gilded clients seek our solution is that direct ownership of physical gold held in insured, non-bank vaults is a secure way to store value that is bankruptcy remote. Banks can and do fail. Deposits are IOUs that may not be repaid. In the United States this is why FDIC insurance was instituted. Taking simple measures to protect a portfolio against losses in the face of bank failures may not seem urgent in periods of calm but it is always prudent because as March 2023 has shown, the unexpected can happen.

Holding Cash Isn’t a Safe Investment Strategy

“Cash is trash.” At Davos in 2020, Ray Dalio, founder of the world’s largest hedge fund, made this assertion and added further emphasis to the maxim in a CNBC interview with a plea to investors to, “Get out of cash. There’s still a lot of money in cash.” The billionaire investor punctuated this point again in 2021 saying, “Cash is not a safe investment, is not a safe place because it will be taxed by inflation.” Financial advisors know this. Holding cash is a problem. Both for investors and for advisors. A big problem.

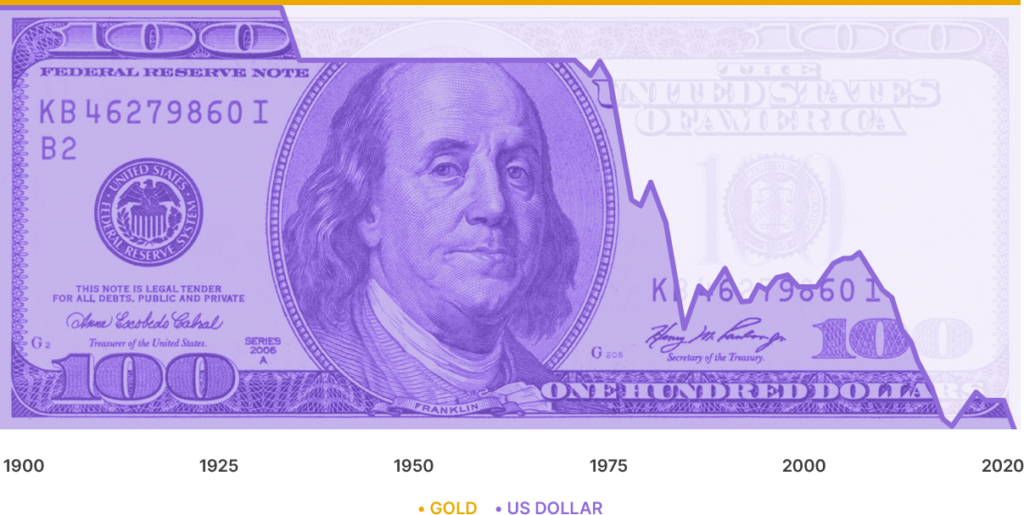

The problems that clients face when holding cash may appear subtle, but they can be significant. First, even small amounts of inflation continually erode the purchasing power of cash holdings. Even low levels of inflation over long periods substantially debase the value of this portfolio allocation. This comes as a surprise only after the passage of time or in cases when inflation spikes unexpectedly higher. More shocking however, is the extent of cash holdings. High net worth clients are holding way too much cash – according to the 2022 Capgemini World Wealth Report investors were holding almost 25% of their portfolio in cash. The graphic above illustrates the potentially destructive nature of this flaw in portfolio allocation. Today’s dollar could only buy about a penny’s worth of goods in the 1930s. For the advisor this poses a real dilemma. Imagine investors allocating a substantial portion of their intergenerational wealth in a supposedly safe investment that loses 99% of its value before it can be handed down to grandchildren?

Another subtle but potentially disastrous problem with cash is the problem of where to put it. When an investor deposits cash at a bank, it ceases to be the investor’s property and becomes a “promise to pay,” an IOU. This is risky and in stark contrast to the perception that cash represents a risk-free investment. The fact is that banks have failed to live up to this promise to pay to such an extent that in the United States the Federal Depositors Insurance Corporation (FDIC) was created in 1933. This was the response by President Franklin Roosevelt to a banking crisis that witnessed over 9,000 failures with over $140 billion in losses in 1933 alone. This problem persists today. Since 2009, 513 banks in the United States have failed. This includes the recent failures of Silicon Valley Bank and Signature Bank. The FDIC has yet to include the failure of Silvergate Bank in its data. Even with FDIC insurance in place this still means that amounts over $250,000 (the FDIC maximum coverage limit per account) are at risk of loss. Although an exception was made to make depositors whole for losses in excess of $250,000 in the recent failure of Silicon Valley Bank, it would be unwise to assume this protection above established FDIC limits will always be made available. For international investors the problem is even more pronounced since many countries do not protect depositors with required federal insurance programs.

Finally, from the perspective of an advisor, the reality is that much of clients’ cash sits outside the auspices of the portfolio and in many cases at one or more separate institutions. For example, the Goldman Sachs private client may hold a mortgage with Wells Fargo, maintaining a cash account to service that mortgage while concurrently maintaining local checking and savings accounts for convenience. This cash represents a pool of assets that does not benefit from a financial advisor’s guidance and often a significant amount that could materially contribute to assets under management.

To inspire a change in the extent of holding cash as well as where that cash is held, advisors can work to make clients comfortable. Fear often drives investors hold too much cash. They fear missing an opportunity to take advantage of market corrections, they fear missing the chance to nimbly take advantage of new business opportunities. They fear unanticipated expenses related to emergencies, changes in health, legal actions, or unforeseen disasters. Digital access to physical gold can provide an answer for advisors in their efforts to get more clients assets onto their platform and to get a portion of these assets out of cash that continually erodes in value and drags portfolio performance down over time.

Digital Gold is a Safer Way to Holding Cash

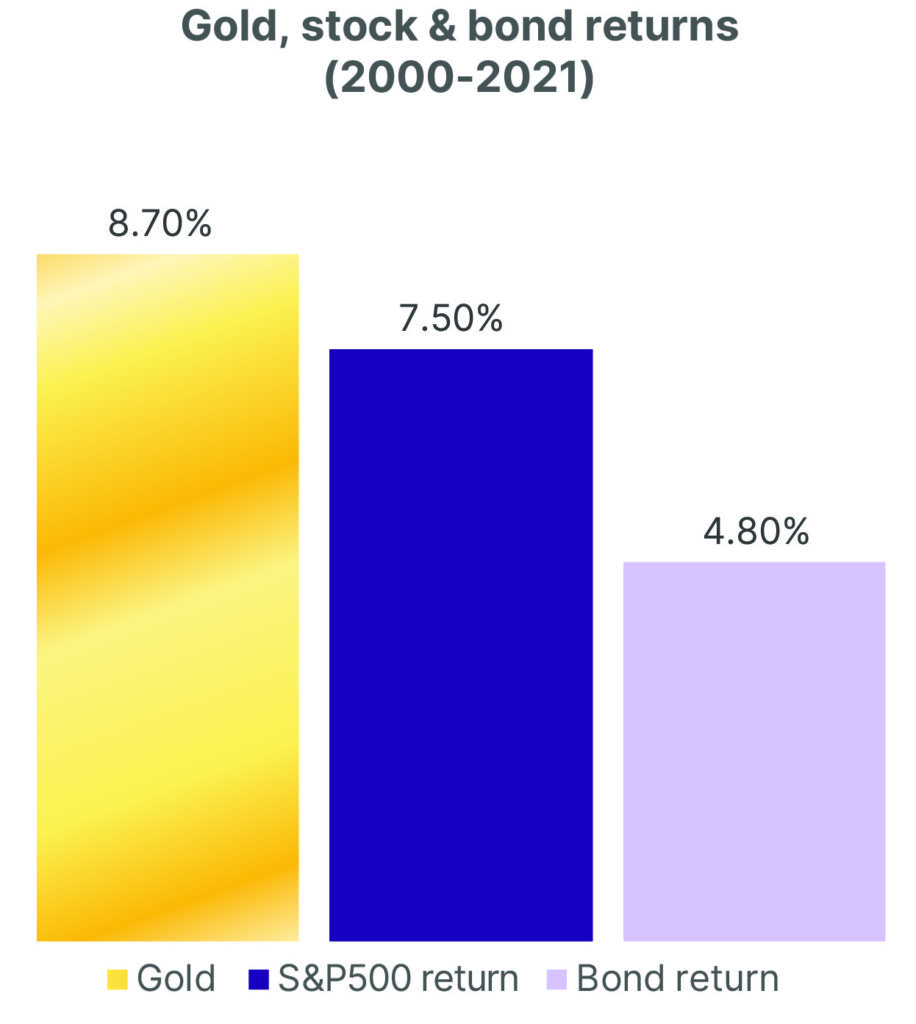

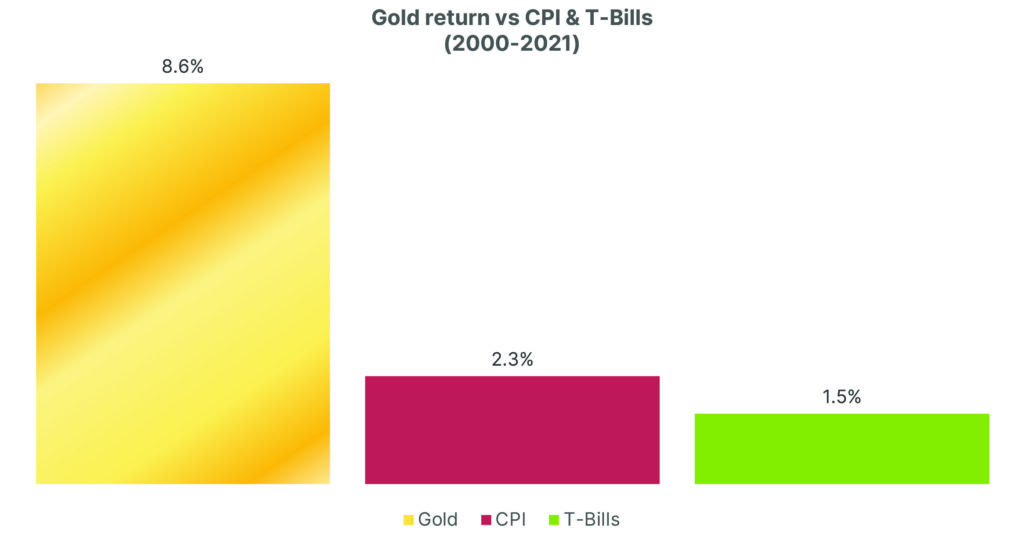

Gold represents an uncorrelated asset class with a history of compelling returns – outpacing equities since the turn of the millennium.

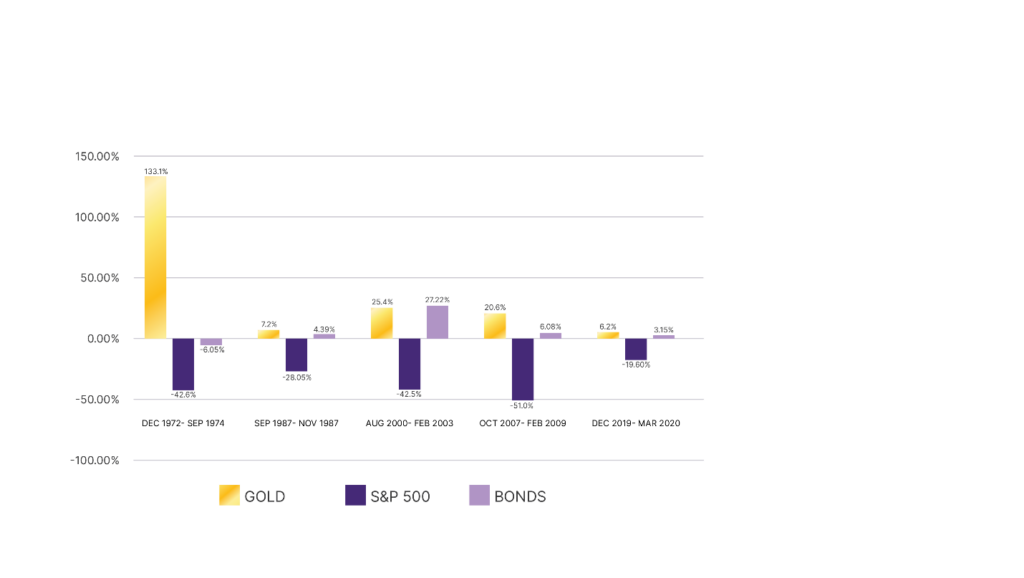

For clients that feel the market may be ripe for a correction, financial advisors can give them comfort that while they wait, they can continue to enjoy the opportunity of compelling returns while not taking on more risk than they like, with gold. If they end up being right and markets suffer a significant correction, they can take comfort in knowing that gold has performed well in stress scenarios such as the oil crisis of the 1970s, the stock market crash of 1987, the Internet Bubble that began in 2000, the 2007-2009 financial crisis and the early months of the COVID pandemic starting in late 2019. Once the stress event has occurred, clients can easily sell their gold and rebalance their portfolio with the help of their advisor.

Digital access to physical gold also offers an answer to the other side of the fear coin – managing unanticipated emergencies. Because Gilded digital gold ownership is immutably recorded on the blockchain, the value of that gold can be moved instantly. This capability endows physical gold with the functionality of cash. For example, it could possibly be pledged as collateral to support derivatives trading and portfolio leverage. Similarly, it can possibly support borrowing to provide liquidity without having to trigger a taxable event in the client portfolio. It can be structured to earn a yield. Specific bars can be swapped to proactively manage taxable gains and losses. In short, by offering physical gold as an option, an advisor can provide clients the functionality of cash but with a better store of value – a history of compelling returns, protection against inflation that cannot be debased by government sponsored printing of money and that is real property outside the risk of a particular counterparty or the financial system.