Research & Blogs

Real Yields and Gold

Real yields offered by any given investment is plain to see in either print or online media. Expressed as a percent, usually annualized but sometimes calculated differently, the stated yield is a rate of return that an investor can expect from having purchased the underlying instrument, e.g., bond or dividend-paying stock, at the stated price, provided the bond issuer or company meets their commitments to service their debt or dividends and the investor holds the instrument until maturity.

Impact of Inflation on Nominal Yields

In economics parlance, the aforementioned yields are often referred to as nominal yields, ‘nominal’ being a qualifier that implies there is more to these plain-to-see yields than a number and percent sign that meets the eye. At times, more than meets the eye actually amounts to less when accounting for inflation. That’s because the inflation rate needs to be subtracted from the nominal yield to get a yield that reflects a generalized rise in price levels, aka inflation.

In other words, while a yield accrues over time, the nominal investment grows, but if over that same period, the prices of real things rise more than the yield, then the result is less purchasing power. Adjusting for inflation to account for these changes is called the real yield.

Real Yields – More Than a Simple Calculation

Real yields are a more complex subject than is suggested by the simple math that gives the difference between a nominal yield minuend and inflation rate subtrahend. Indeed, developments in real yields in and of themselves have long been a subject of debate in academic circles. But now, with a new look at policies – monetary and fiscal – enacted to combat the economic fallout from the Covid-19 pandemic, real yields have become a hot topic in markets, too. This is especially true in the US, which we will focus on here for the sake of brevity; the concepts are generally applicable to other countries.

Treasury Inflation Protected Securities (TIPS)

Markets’ go-to indicator to gauge developments in real yields is usually inflation-linked bonds, which in the US are called Treasury Inflation Protected Securities (TIPS). The ‘protection’ TIPS provide derives from their principal amount getting adjusted higher as the Consumer Price Index (CPI) rises. In other words, the stated coupon rate paid on a higher principal amount is designed to compensate for inflation. TIPS are a two-way street, however, as the principal amount also gets adjusted lower when CPI falls.

TIPS yields, and nominal Treasury yields for that matter, are typically driven by inflation – realized and expected – as well as by the market’s assessment of where the Federal Reserve’s monetary policy is heading. Growth expectations can be added to the mix because those too can have bearing on inflation and Fed policy. TIPS and nominal yields are also interrelated insofar as the difference between the two gives an idea of how markets are pricing inflation for a given time frame. This difference is called the breakeven inflation rate. For example, again using simple math at a point in time, a nominal 5-year yield of 3.0% and 5-year TIPS yield of 1.0% implies inflation (breakeven) in five years at 2.0%.

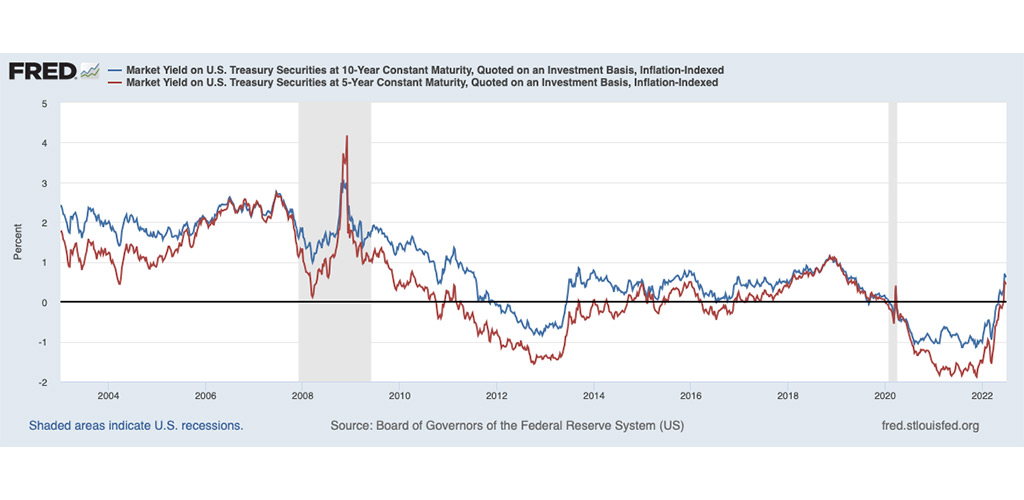

The apparent oddity nowadays is that despite having rebounded from their 2021 lows, 5-year and 10-year TIPS yields (the most widely referenced tenors, see chart) have spent recent months below zero – even with the Fed having begun normalizing its monetary policy and, moreover, with inflation running at a 40-year high (8.6% y/y in May). While it was hardly surprising to see nominal and TIPS yields tumble as the Fed in March 2020 pulled out all the monetary stops in an attempt to cushion the blow from the pandemic, why real yields remained in negative territory, especially with US employment prospects still resilient, is a bit of a head-scratcher. We’ll leave that to the academics to figure out.

Overall

Our point is twofold. First, the negative correlation between nominal yields and the gold price, as is plainly evident to even casual observers of the gold market, tells only a partial story; the value of the US dollar, geopolitical tensions, etc. can and do play roles too, oftentimes impacting the gold price significantly. And second, real yields, which are arguably a more important indicator because they reflect real, i.e., inflation-adjusted, conditions, could suggest less of a threat to gold than might their nominal counterparts.

The adage “what you see is what you get” doesn’t necessarily apply when it comes to yields. Nominal yields may get top billing, but real yields matter too. Unless and until real yields move much higher, gold would seem to have little cause for undue concern.