Research & Blogs

Your Clients Want Gold – Now It’s up to the Advisor to Recommend the Right Form

Advisors have no shortage of justifications for recommending a portfolio allocation in gold to their clients. Clients however have a variety of needs and priorities when it comes to choosing gold as an investment. Those priorities can really help an advisor when it comes to selecting the type of gold that is right for each client. In general, gold can be acquired in three unique forms: paper gold – as with ETFs; physical gold – in the form of bars or bullion; or digital gold. Gilded specializes in digital gold. This is physical gold, fully allocated and stored in fully insured Brinks vaults beyond the risks of the banking system. Gilded uses blockchain and other modern technology to enable the value of client gold to be transferred instantly, thus endowing traditional physical gold with the functionality of cash.

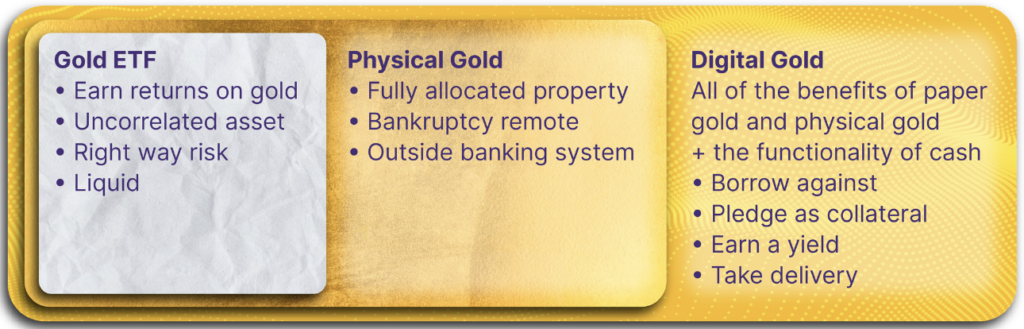

The graphic below depicts how the benefits provided by paper gold represent a subset of the benefits provided by physical gold. In turn, digital gold includes the benefits of both paper gold and physical gold. Each form of gold has its merits and drawbacks, which taken together can help the advisor align an appropriate choice with the specific priorities of each client. Each category deserves an overview.

Paper gold provides approximate exposure to the price movements of gold. Commonly taking the form of an exchange traded fund or shares in a gold mining concern, this option delivers access to the compelling historical returns of gold, the uncorrelated nature of the asset relative to stocks and bond, and the right way risk exposure that gold has exhibited in past scenarios of market stress. It is easy to acquire and to sell. For the client that is looking only for short-term exposure, this is a viable option.

Physical gold provides the same price-related benefits as paper gold. Physical gold also has the benefit of being property that can be held outside the fractional reserve banking system. This means that investors aren’t relying on the sound management of gold company executives or ETF Trustees, Custodians or Sub-Custodians to ensure the safety of their gold. Furthermore, unlike company or ETF shares that need to be held in custody at a brokerage firm, physical gold can be stored in a non-bank vault, or in a client’s own home. While paper gold can be acquired and disposed of quickly, physical gold ownership is a process. It must be sourced (some investors will put added emphasis on the ethical sourcing of gold), it must be assayed for quality, then transported, stored and insured. The sale of physical gold takes time and must be accomplished during normal business hours. For clients that consider system risk an ongoing concern and expect to hold for the long-term, this is a viable option. Advisors should keep in mind that investment in physical gold means client assets will be held outside their auspices.

Digital gold offers all the price benefits of paper gold, plus all of the bankruptcy remote benefits of property inherent in physical gold, but with ease of access and with functionality. Clients can acquire and dispose of their physical gold around the clock. The gold offered on the Gilded network is sourced from long-established, reputable refiners, meets the ethical standards mandated by the London Bullion Market Association, and is of the highest quality at .9999 percent pure1. With instantaneous value transfer enabled and immutably recorded on the blockchain, clients will soon be able to access liquidity to take advantage of opportunity or to manage the unexpected by borrowing against their gold holdings or pledging gold on an exchange to trade derivatives. They can even soon enough be able earn a yield on their gold using structured products. In each of these cases, clients can again very soon be able to optimize the timing of taxes since the gold need not be sold to access liquidity. Unlike paper gold, owners of Gilded’s digital gold can arrange for delivery. Unlike physical gold, digital gold can be accessed anytime, and in many ways, used like cash. After all, purchased Gilded gold is the client’s property, it is their title, fully allocated, fully insured and through the use of modern tools afforded with many functionalities of cash.

1 n.b. .9999 percent pure exceeds the standards set by the London Bullion Market Association for good bar delivery of .995 percent.