Research & Blogs

An Advisors Guide to Guiding Clients Through Inflation

Since the decoupling of global currencies from gold in 1971, inflation has proved the rule rather than the exception. Even at low levels, it’s always there eroding the purchasing power of cash. Investors tend not to notice this constant threat, until rates of inflation spike. At times like these – 2022 – for example, clients start asking pointed questions.

What advice can advisors offer?

Well for starters, one piece of sound advice might be to fast-track any necessary or discretionary purchases before prices rise. While sensible – even prudent, this suggestion likely fails to make a sufficient impact on the average private wealth portfolio. There is more work to be done.

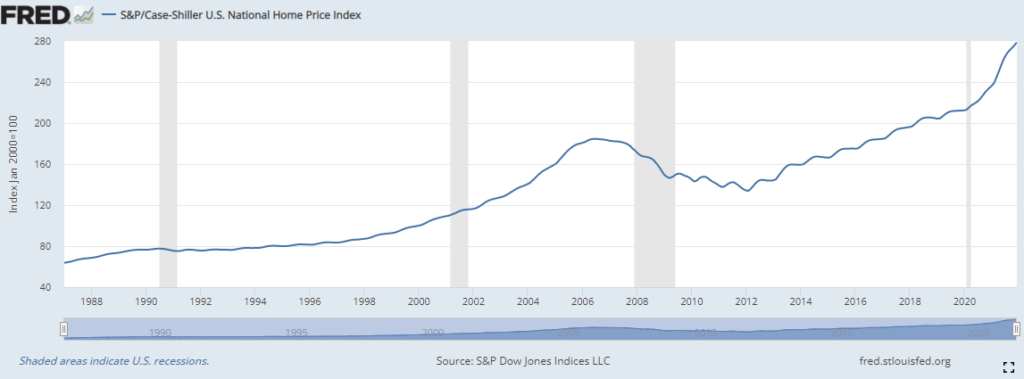

Investments in property, like real estate, art, antiques or collectibles tend to perform well during periods of pronounced inflation. Research out of Stanford University examined the Great Inflation of the 1970s and found that “, beliefs about future inflation induced a portfolio shift towards housing.” Art has shown similar resilience. “The Art 100 Index, compiled by Art Market Research, shot up 130 percent from 1977 to 1982, a period in which prices rose 80 percent.”

But following that advice, where does that leave a client who requires greater short-term liquidity than that afforded by illiquid physical assets?

It isn’t easy or inexpensive to liquidate a property or a Picasso. And how comfortable can an advisor really be recommending real estate when the Case-Schiller Housing Index has never been higher than it was in December 2021 since inception.

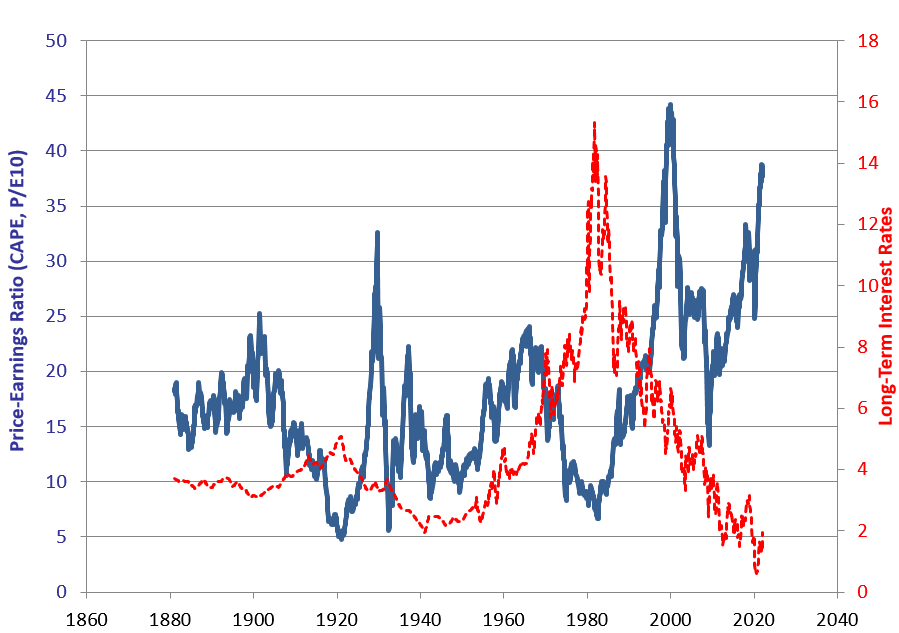

What about equities? Over the long haul, stocks have indeed been a reliable safe harbor against inflation. But there have been long periods with inflation when stocks did not perform well. The “lost decade” following the Great Recession is one example. The stagflation that began in the 1970s, is another. And calling upon Nobel laureate, Robert Schiller, once again, this time for his CAPE Ratio, we find that stocks have rarely been as highly valued as at the end of 2021. In fact, the only time since 1871 that stocks were as highly valued was prior to the Internet bubble at the turn of the millennium. Finally, inflation advice is usually more about reducing investment in cash that is being debased, than about taking on additional portfolio risk. So, recommending more stocks might be tough.

How comfortable is any advisor recommending taking on more risk in a risk-off environment, especially in the face of pricey valuations?

Inflation protected bonds (TIPS) are built for purpose, right? Well … yes and no. In January 2022, the Consumer Price Index hit 7.5% while 10-year US Treasury bond yields hovered just under 2%. This means investors that hold bonds to maturity are signing up to lose over 5%. This is a tough pill to swallow. TIPS are better, but still point to negative real yields of -1.5%. And what if central bankers around the world need to dramatically raise rates to combat unexpected inflation? Suddenly, the “risk-free” aspect of bond evaporates if a 40-year trend of declining rates is reversed.

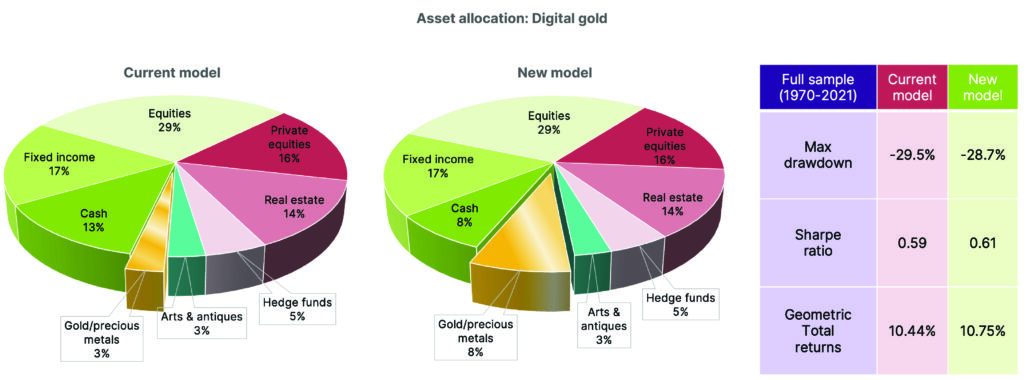

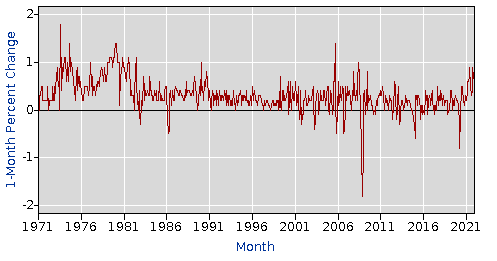

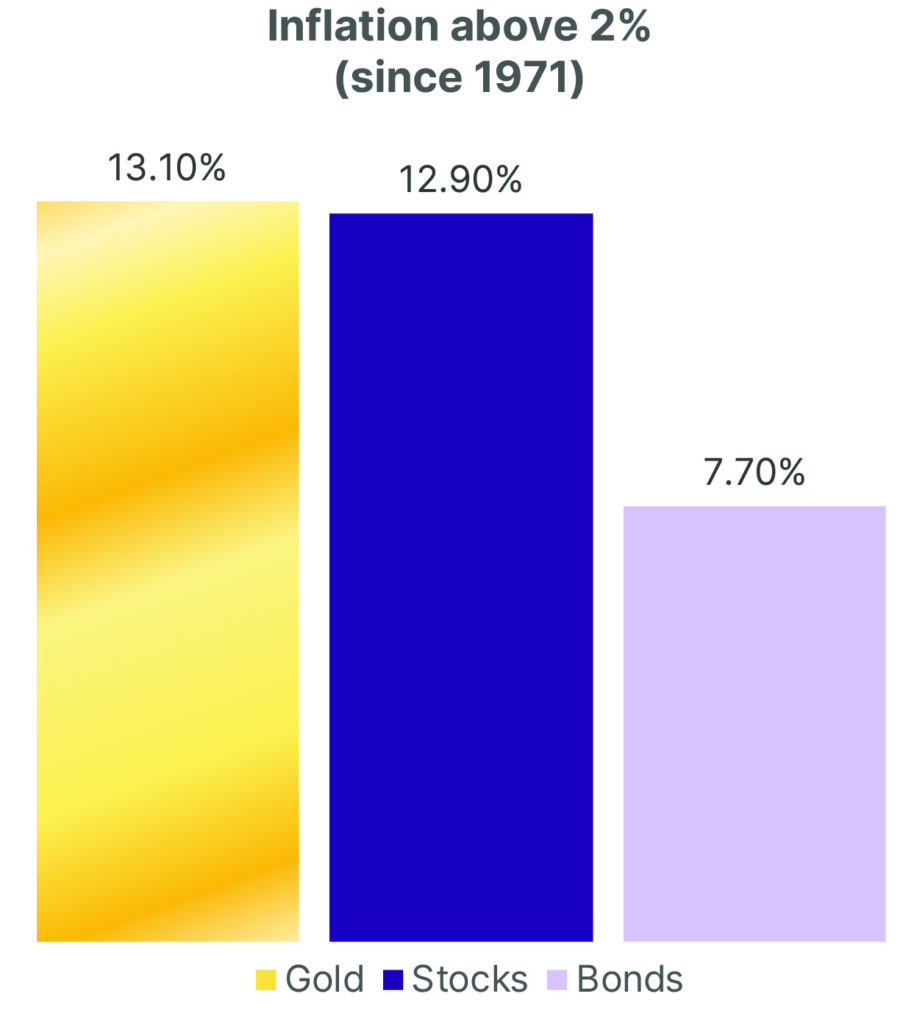

Maybe the answer has been here all along. Gold. Gold offers a history of compelling returns even when compared against equities. Gold with a low historical correlation to market beta (stocks and bonds) offers a diversifying addition to most portfolios that could add to returns while lowering risk. This can be seen in the graphic below that examines a typical portfolio mix that benefits from higher expected returns and lower risk (yielding a higher Sharpe Ration) by reducing the portfolio allocation to cash by 5% and redirecting the investment to gold. And perhaps most germane to the conversation, Gold has historically done well during inflation and even better when inflation exceeded normal expectations (See chart).

Like now.